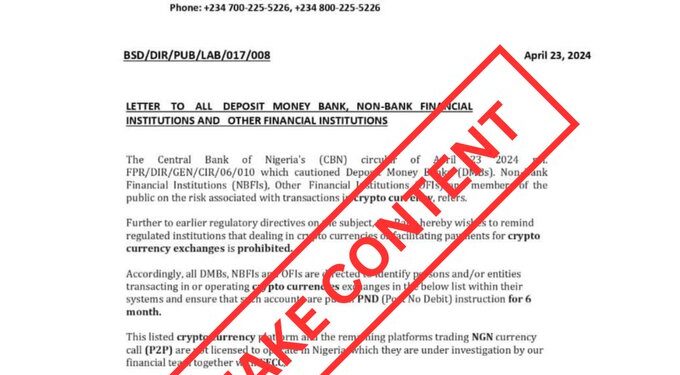

The Central Bank of Nigeria (CBN) has debunked a recent news circular circulating online that claims to be a letter from the CBN cautioning financial institutions about cryptocurrency transactions. The purported letter, labeled as CBN circular FPR/DIR/GEN/CIR/06/010, allegedly warned Deposit Money Banks (DMBs), Non-Bank Financial Institutions (NBFIs), and other financial institutions about the risks associated with cryptocurrency transactions.

In response, the CBN clarified that no such circular was issued by the bank. The CBN emphasized that it has not issued any directive prohibiting financial institutions from dealing in cryptocurrency exchanges or facilitating payments for crypto transactions.

Furthermore, the CBN stated that it remains committed to fostering a transparent and regulated financial system in Nigeria. While acknowledging the risks associated with cryptocurrencies, the CBN reiterated that it is open to exploring innovative financial technologies that comply with existing regulations and enhance the efficiency of the financial sector.

The CBN advised the public to disregard the false information contained in the purported circular and cautioned against spreading misinformation that could create confusion in the financial markets.

Additionally, the CBN debunked the fake circular on its official X (Twitter) page, urging the public to verify information from credible sources. This clarification from the CBN aims to reassure the public and financial institutions that there has been no change in the bank’s position regarding cryptocurrency transactions. The CBN remains focused on promoting financial stability and protecting the interests of all stakeholders in the Nigerian economy.