The Association of Bureaux De Change Operators of Nigeria (ABCON) is raising the capacity of its more than 45,000 licensed operators to avert the criminal intent of Politically Exposed Persons, who may take advantage of their ignorance.

The move, according to the association, became necessary, as it realised that money laundering and terrorist financing pose not only a threat, but enormous challenges to the economy, security, and social life in Nigeria, the region and globally.Besides, the group said it is preparing its members for the yearly evaluation by the Financial Action Task Force (FATF), due for a visit to the country soon.

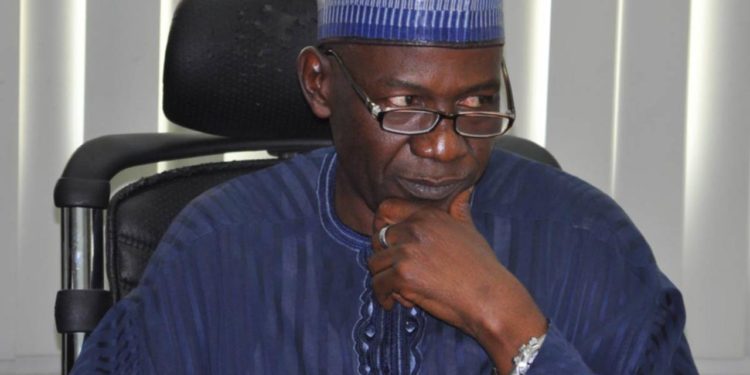

ABCON President, Alhaji Aminu Gwadabe, while speaking to financial journalists ahead of the FATF visit, yesterday, said the association, in collaboration with the Central Bank of Nigeria (CBN) is organising a sensitisation workshop for the more than 4,500 licenced operators.

Gwadabe said there is need to create awareness and raise capacity of its members to check money laundering and terrorist financing; ensure that operators are not used to launder funds by Politically Exposed Persons (PEPs).

Also, it will upscale BDCs’ compliance with the Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT) for banks and other financial institutions in Nigeria.He said the expected visit and need for compliance became necessary after the FATF team in February, named Nigeria in a proposed European Union blacklist of nations seen as posing a threat because of lax controls on terrorism financing and money laundering.

The criteria used to blacklist countries include low sanctions against money laundering and terrorism financing, insufficient cooperation with the EU on the matter and lack of transparency over the beneficial owners of companies and trusts.To ensure effective coverage, he said the workshop, will be held across the six geopolitical zones of the country, beginning from next one week, as part of ongoing capacity building on the obligation of registering and filling reports on the Nigerian Financial Intelligent Unit’s (NFIU) goAML -Anti-Money Laundering portal.

He said the anti-money laundering training is intended to familiarise BDC operators with the process of money laundering — the criminal business used to disguise the true origin and ownership of illegal cash — and the laws that make it a crime.Gwadabe said that the training was also meant to help BDCs maintain minimum standard of record keeping and increasing level of investors’ confidence for the economy.

Gwadabe said visit by the FATF team will enable the global body see new efforts by the country to tackle money laundering and terrorist financing.He said that as the global body that sets standard for AML/CFT efforts, the FATF team will also assess banks and other financial institutions compliance with the Anti-Money Laundering and Counter Financing of Terrorism (AML/CFT) measures.