The Central Bank of Nigeria (CBN) has directed banks to pay at least 4.65% interest on savings deposit accounts, up from 4.2% earlier.

This is due to a 150 basis point increase in monetary policy rates to 15.5% from 14%. This hawkish decision by the central bank resulted in an increase in the interest rate on savings deposits, which has the potential to mob up the money in circulation.

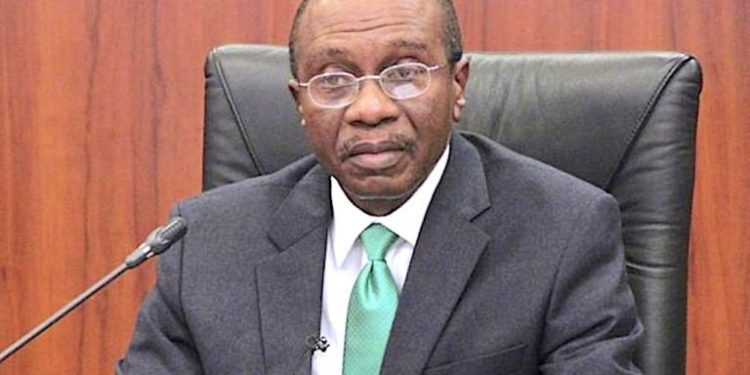

Mr Godwin Emefiele, Governor of the Central Bank of Nigeria (CBN), announced the MPR modification at Tuesday’s monetary policy committee meeting.

Context: The Monetary Policy Rate (MPR) is the rate at which the CBN lends money to banks. It is a benchmark rate for lending in the financial services sector. Savings deposit rates are default rates banks pay customers for keeping their money in the banks. Previously, the MPR was pegged at 14% by the CBN and 30% of that is 4.2%. Currently, the MPR is at 15.5% and 30% of that is now 4.65%.

The Central Bank of Nigeria recently increased the negotiable minimum interest rate on local currency savings deposits from 10% to 30% which took effect on August 1, 2022.

An increase in the interest rate on a savings deposit is typically expected to increase savings and serve as a form of contractionary monetary policy.However, because inflation has surpassed all of these rates and any money saved loses purchasing power over time.

Nigeria’s inflation rate surged further to 20.52% in the month of August 2022, from 19.64% recorded in the previous month, representing the highest rate since September 2005.

Bank customers to earn more as CBN increases interest on savings deposits to to 4.65%

The Central Bank of Nigeria (CBN) has directed banks to pay at least 4.65% interest on savings deposit accounts, up from 4.2% earlier.

This is due to a 150 basis point increase in monetary policy rates to 15.5% from 14%. This hawkish decision by the central bank resulted in an increase in the interest rate on savings deposits, which has the potential to mob up the money in circulation.

Mr Godwin Emefiele, Governor of the Central Bank of Nigeria (CBN), announced the MPR modification at Tuesday’s monetary policy committee meeting.

Context: The Monetary Policy Rate (MPR) is the rate at which the CBN lends money to banks. It is a benchmark rate for lending in the financial services sector. Savings deposit rates are default rates banks pay customers for keeping their money in the banks. Previously, the MPR was pegged at 14% by the CBN and 30% of that is 4.2%. Currently, the MPR is at 15.5% and 30% of that is now 4.65%.

The Central Bank of Nigeria recently increased the negotiable minimum interest rate on local currency savings deposits from 10% to 30% which took effect on August 1, 2022.

An increase in the interest rate on a savings deposit is typically expected to increase savings and serve as a form of contractionary monetary policy.However, because inflation has surpassed all of these rates and any money saved loses purchasing power over time.

Nigeria’s inflation rate surged further to 20.52% in the month of August 2022, from 19.64% recorded in the previous month, representing the highest rate since September 2005.

ANonetheless, Nairametrics believe there are money-making opportunities prevalent In these high-interest rate environment to understand more read here.

If the inflation rate exceeds the interest earned on a savings or checking account, then the investor is losing money. Inflation tends to cut into a consumer’s purchasing power over time. Fortunately, there are ways of preserving the purchasing power of your savings. That means investing, but keeping your level of risk moderate.

If the rate of inflation surpasses the rate of interest generated on a savings, the investor loses money. Inflation is likely to erodes a consumer’s purchasing power over time. Fortunately, there are ways to keep your savings purchasing power intact. That implies investing while keeping your risk level low.