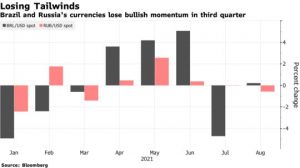

Some of this year’s best-performing emerging-market currencies are falling out of favor as traders trim back bets on further interest-rate hikes.

The Brazilian real and the Russian ruble, which outpaced most of their peers in the first half amid policy tightening, have now gone into reverse. The real has slumped about 4.5% since the end of June, more than any other major currency tracked by Bloomberg.

The tightening cycle was in full force in emerging markets long before the Federal Reserve started laying out a timeline for scaling back its bond-buying program, which Chair Jerome Powell said on Friday could begin as soon as this year. The early hikes in Russia and Brazil have helped stem flows from emerging markets, though policy makers are still balancing the need to battle inflation with the desire to support economies battered by Covid-19.

Poland and Colombia may be next to lift rates. That offers some upside potential for lagging currencies such as the Polish zloty, protecting their relative yield advantage against accelerating prices and the prospect of rising U.S. rates.

“Early hikers, where the speed of tightening has been in line with or in some cases faster than historical hiking cycles, are likely to slow the pace of hikes or pause in the months ahead,” Goldman Sachs Group Inc. strategists led by London-based Kamakshya Trivedi wrote in a note this month. “The second half of the emerging-market hiking cycle is likely to be even broader, with more central banks commencing some form of normalization.”

Evolving Environment

Brazil’s central bank has already increased its key rate by 325 basis points this year, more than most peers, and forward-market bets are pricing in slowing rate hikes after September’s meeting. In Russia, traders predict the central bank will increase its benchmark by about 50 basis points over the next three months, down from more than 130 points in early July.

“Markets will likely continue to chase yield, meaning those countries, with relatively aggressive monetary stances and higher real yields will benefit most,” he said.

Balancing Act

It’s a delicate balancing act for policy makers, who have to battle rising prices without stifling growth as the threat of Covid-19 variants continues to loom over the global economy. Poland for one has signaled it wants to keep monetary policy loose until the economic rebound is well under way despite surging inflation.

Still, the eastern European country may be the next in line after the economy expanded at its fastest-ever annual pace in the second quarter, with Deutsche Bank AG predicting hikes in October and November. The zloty this year has underperformed the currencies of Hungary and the Czech Republic, which have embarked on aggressive monetary-tightening campaigns to keep inflation under control.

Poland stands out as an emerging market that has been “behind the curve when it comes to raising rates,” said Oliver Harvey, a London-based strategist at Deutsche Bank. Its dovish policy stance has weighed on the currency, which the bank says is about 10% undervalued based on its models. If the central bank were to turn more hawkish later this year, the zloty could be a catch-up trade, he said.

Fresh hawkish sentiment is also emerging in Colombia, where the central bank has signaled it may soon join the regional trend for higher interest rates as inflation quickens. Policy makers see the economy expanding at 7.5% this year. Economists see policy makers increasing the key rate by 75 basis points this year, from a record low of 1.75%.

“We expect policy makers in Asia and Eastern Europe to tighten very gradually, with timing of hikes dependent on decisions by the Fed” and European Central Bank, said Lewis Jones, an emerging-market debt portfolio manager at William Blair Investment Management LLC in New York. “Central Banks in Latin America and among the higher-yielding countries elsewhere are acting more aggressively to stave off medium-term inflation outlook concerns, while the overall hiking cycle is likely to be relatively short.”

In the coming week, investors will also watch rate decisions from Chile and Zambia.

Policy Clues

- Chile’s central bank is expected to increase its key rate by 50 basis points while employing a more hawkish tone amid fiscal stimulus measures and higher-than-expected inflation readings

- Zambia’s central bank is expected to leave rates unchanged, with inflation slowing as the kwacha’s world-beating streak helped rein in import costs

- In Mexico, investors will scour the quarterly inflation report to be released Tuesday for clues on the path for monetary policy

- Turkey’s August inflation reading due Friday will be closely watched as it will likely influence the next policy decision on Sept. 23. Investors have been returning to Turkey’s debt market amid relief that the new central bank governor hasn’t succumbed to President Recep Tayyip Erdogan’s calls for lower interest rates

- Data on Wednesday is predicted to show Turkey’s economic growth accelerated to 21% in the second quarter from a year earlier because of a favorable base effect

- “The momentum of economic activity is likely to continue to soften going forward in the face of the ongoing uncertainty about the pandemic situation, elevated FX volatility and interest rates,” Citigroup Inc. economists, including Ilker Domac and Gultekin Isiklar, wrote in a note

PMI Data

- China’s data will offer a first look at how the economy fared in August after sweeping curbs were reimposed to contain the spread of the delta variant. Manufacturing and non-manufacturing PMIs are set to be released on Tuesday

- The China figures will reflect the impact of the latest Covid-19 cases, which resulted in closures at marine ports and airports, with knock-on effects to trade and industry as well as tourism and leisure, according to a note from ING Groep analysts led by Robert Carnell in Singapore. The yuan has weakened this month

- South Korea, Taiwan, Malaysia, Indonesia, Thailand and the Philippines will release gauges of factory activity on Wednesday. China’s Caixin manufacturing PMI is due the same day

What Else to Watch

- India is expected to report on Tuesday that GDP growth quickened to 21% in the second quarter from 1.6% in the previous three months due to a low base effect

- The year-on-year growth rate masks the underlying weakness caused by the latest Covid-19 spread, which was much deadlier than last year, according to ING

- The rupee has weakened about 0.8 % this year

- South Korea reports industrial production on Tuesday, trade figures Wednesday and final second-quarter GDP on Thursday

- Thailand is forecast to report on Tuesday that its current-account balance remained in deficit in July, which may damp last week’s exuberance over the baht after authorities said the virus outbreak has peaked. The current-account balance has been in a shortfall since November

- Indonesia will kick off a spate of CPI readings for August on Wednesday, followed by South Korea on Thursday

- Traders will watch for any potential market impact from Brazil’s 2022 budget proposal, which must be submitted by Aug. 31

- The nation is also scheduled to release June’s national unemployment figures on Tuesday as well as second-quarter GDP data the following day

- Industrial-production numbers for July, to be published on Thursday, will reflect weak performance in the auto sector, according to Bloomberg Economics

- Colombia’s urban unemployment data for July, to be released on Tuesday, will show a decrease from a month earlier amid economic reopenings, according to Bloomberg Economics