It’s been 10 years since Standard & Poor’s took the unprecedented step of lowering the flawless AAA grade of U.S. debt.

The credit rating company said at the time that it had been forced to act by “political brinksmanship” in Congress, where cycles of drama over raising the debt ceiling to avoid default made the world’s largest economy “less stable, less effective and less predictable.” In response, Treasury Secretary Timothy Geithner denounced what he called the rating company’s “terrible judgment,” and declared that “there’s no risk the U.S. would never meet its obligations.”

History has been much kinder to Geithner than to S&P. Bond investors have only increased their confidence in U.S. government debt, pushing its value up and its interest rates down. S&P shows no signs of reversing a decision that appears meaningless a decade later, with the U.S. outperforming every developed economy and prevailing as the greatest magnet for global investors.

Still, political brinkmanship over the debt ceiling continues to flourish, too. Senate Minority Leader Mitch McConnell refuses to work with Democrats as another debt ceiling deadline looms in October.

And the alarms being sounded about the consequences echo the warnings issued by S&P back on Aug. 5, 2011. Treasury Secretary Janet Yellen earlier this month told colleagues at the Federal Reserve, the Securities and Exchange Commission and the Office of the Comptroller of the Currency that there may be “financial stability implications” if Congress fails to raise the debt limit to allow the U.S. government to pay debts coming due next month.

Who knows? Maybe Chicken Little will be right this time. But a review of what happened after S&P acted suggests otherwise.

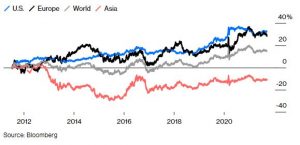

Anyone who bought $10,000 of benchmark 10-year Treasuries on July 14, 2011, when S&P first said it might downgrade the U.S. because of unsustainable deficits, would have turned that investment into $15,000, or a total return (income plus appreciation) of 50% today, according to data compiled by Bloomberg. Even after infusions of central bank liquidity, the inflation-adjusted return of the full faith and credit of the U.S. is superior to any sovereign return from Asia or Europe among developed economies.

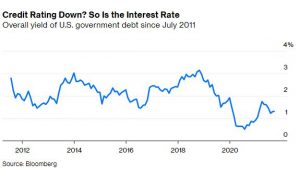

The most pronounced trend has been the unabated demand for Treasuries at lower yields. Back in 2011, between the news of a possible downgrade and the Aug. 5 decision, the cost of government borrowing fell as much as 55 basis points to 2.4%, then the lowest interest rate during the previous 10 months, according to data compiled by Bloomberg. The appetite for Treasuries brought the rate on the benchmark bond to a low of 0.5% on Aug. 4, 2020 and it changes hands today at 1.3%.

During the 2,568 trading days since the S&P announcement, there were only 110 days when the yield was higher than 2.95%, where it had stood on July 14, 2011, or 4 out of every 100 days. Since August 2019, the U.S. borrowing cost has never exceeded the 10-year average of 2.06%. The current yield is 0.77% less than the 10-year average, according to data compiled by Bloomberg.

The downgrade was embraced by traders as a contrary indicator of confidence in U.S. stability. Implied volatility, which measures trading bets on the extent of bond-price fluctuations, declined to 48% from 118% after the downgrade — the lowest level since data was compiled in 1987. The same measure of market anxiety is hovering 10 percentage points below the 10-year average, according to data compiled by Bloomberg.

Since 2011, U.S. government debt returned 32% to investors, beating the 26% from European Treasuries, World Treasury’s 13% and Asia Treasury’s loss of 11%, according to Bloomberg bond indices. That’s another way of showing that the U.S. outperformed every competitor across the globe in the decade following the downgrade.

Downgraded Yet Still on Top

Total 10-year return in U.S. dollars of global and regional government debt indexes

If anything, the U.S. has become a more effective borrower, with the average monthly issuance increasing more than $1 trillion, compared to an increase of $483 billion 10 years prior to the downgrade, according to the Securities Industry and Financial Markets Association. Borrowing at lower rates of interest when the supply of Treasuries increased is an indication of greater creditworthiness, the opposite of the S&P judgment.

The U.S. isn’t alone making a mockery of credit downgrades. Bond prices rose and interest rates declined in the 200 days after ratings were lowered for Austria, Finland, France, Greece, Japan and New Zealand, according to data compiled by Bloomberg. Current yields on all of those countries’ bonds today are lower than when they were downgraded.

Investors continue to agree with Geithner’s assertion of American resilience. Since the end of 2011, the inflation-adjusted gross domestic product of the U.S. increased 16.3%, almost twice as much as the closest competitor within the Group of Eight industrialized nations, according to data compiled by Bloomberg.

Raising the debt ceiling to pay for the spending and tax cuts passed by Democratic and Republican administrations going back decades is essentially a ministerial responsibility enabling the Treasury to sell bonds financing government operations. Democrats seem to have the votes to do so without support from Republicans. That helps explain why investors are indifferent to the latest Congressional follies.