The CBN governor expressed his appreciation for the fintech companies that have helped boost the efficiency and convenience of online transactions.

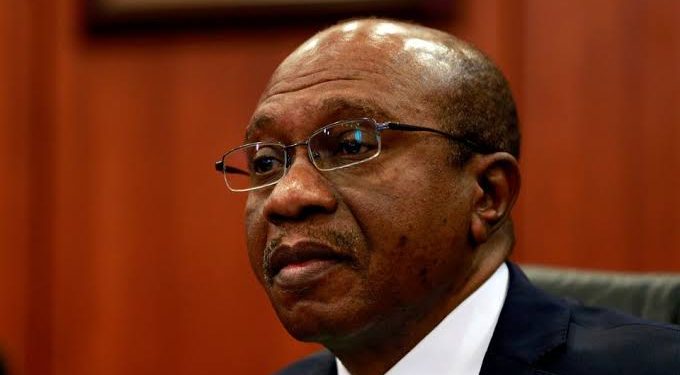

Speaking on Tuesday in the 290th monetary policy committee press briefing, Godwin Emefiele acknowledged the growth of fintech companies, their importance in online banking, and their boost in promoting a cashless society.

Emefiele noted that with these companies, there are now more options available than just relying on banks alone when it comes to making payments online. This is helping to drive a transition towards cashless societies, which he believes will be beneficial for economic growth and development in Nigeria.

Fintech firms have been instrumental in reducing transaction costs and providing access to financial services for those who were previously unable or unwilling to use traditional banking outlets due to high fees or a lack of trustworthiness associated with them. Additionally, they are also providing new forms of digital payment solutions, such as mobile wallets, which can be used even without having an account at a bank institution; this helps people from all walks of life make payments conveniently.

The CBN governor also admitted the challenges faced by bank customers following the failed online transactions in the traditional banking sector and apologized for the deluge of online transaction failures in the country. He acknowledged that these issues are due to a high volume of transactions hitting banking systems that have caused some technical difficulties with online payments.