The Central Bank of Bigeria has ordered banks 48 hours to comply with the new Cash reserve ratio (CRR) rate, or they will be barred from participating in the official exchange rate market.

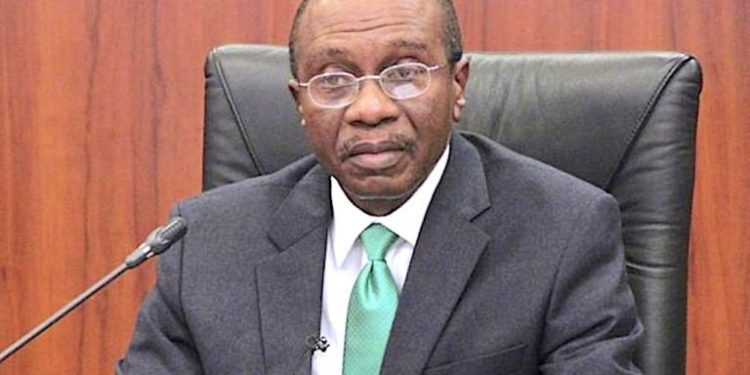

This was revealed by the Governor of the Central Bank of Nigeria (CBN) Mr Godwin Emefiele at Tuesday monetary policy committee meeting.

The central bank increased the CRR by 18.18%, from 27.5% to 32.5%, in order to ensure that the counter-inflationary policy is effective.

He said, “We have increased the CRR, and we expect that this decision at the meeting will be perceived as potent and will have the effect of the MPC.”

He added“We expect that all Nigerian banks would need to fund their accounts by Thursday (48 hours) in order for us to debit them for CRR. We would increase their CRR to a minimum of 32.5%, which means we would withdraw liquidity from their volts on Thursday.”

The apex bank said the banks would not be able to access the office forex market “If any bank fails to meet the expectation, the MPC may need to preclude the banks from the forex market on Friday and onwards until they meet the 32.5%.”

This implies that any affected bank would not be able to fulfil PTA or BTA request for their consumers

He also added that the message mearnt to underscore the fact that MPR aggressive decision to rain in results. “We don’t want to faces Nigeria in the next two months and begin to take the blame for not raining in inflation despite the rate hikes,”he said.