To gain control of the currency circulation, the Central Bank of Nigeria, CBN, has started the process of revamping Nigeria’s currency notes, the Naira.

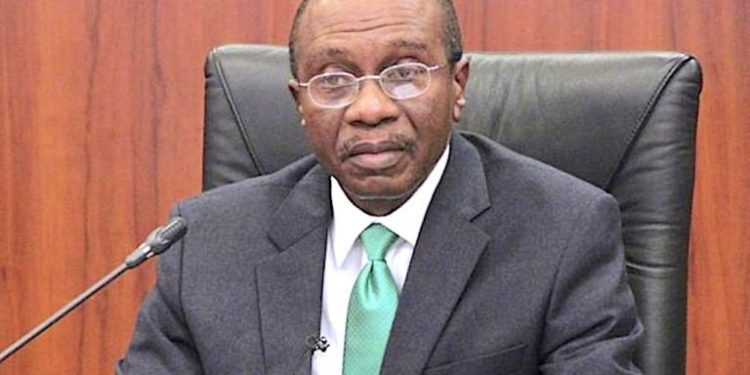

At a news conference in Abuja yesterday, the governor, Mr. Godwin Emefiele, announced that the process will affect the higher denominations of the notes: N200, N500, and N1000.

Emefiele explained the exercise’s justifications, stating that the CBN would not tolerate the scenario as long as the majority of the country’s cash notes were kept outside of bank vaults.

According to him, there have been several difficult problems with currency management recently that have grown in scope and sophistication, with unanticipated effects on the CBNs and the nation’s integrity.

Some currency management challenges the CBN Governor highlighted

“Significant hoarding of banknotes by members of the public, with statistics showing that over 85 percent of currency in circulation is outside the vaults of commercial banks.”

“Available data at the CBN indicate that N2.73 Trillion out of the N3.23 trillion currency in circulation, was outside the vaults of Commercial Banks across the country; and supposedly held by the public.”

“In recent years, the CBN has recorded significantly higher rates of counterfeiting especially at the higher denominations of N500 and N1,000 banknotes.”

The CBN is persuaded that as access to the substantial amount of money utilized as a source of funding for ransom payments outside of the banking system starts to dry up, occurrences of terrorism and kidnapping will be reduced.

Furthermore, the CBN believes that the redesign of the currency, which is long overdue (Nigeria’s existing series of the naira has not been redesigned in the last 20 years), will strengthen its efforts to establish a cashless society because it will be accompanied by a rise in the production of the eNaira. This will further control the currency outside of the banking system, improving the effectiveness of the monetary policy.

How this policy will affect the funds in circulation

Although the CBN did not say categorically that the policy will beat down inflation and strengthen the domestic currency, it nevertheless expressed optimism about the positive impact the policy will have on the value of the naira. The apex bank also thinks mopping up the monies outside the banks’ vaults will help slow inflation.

Assessing the possible impact of this policy on the high level of inflation in the country shows that this policy will very likely not bring down inflation. Nigeria’s inflation is not demand-induced, rather it is more associated with rising costs, insufficient production, and supply chain disruptions. Therefore, mopping up liquidity in the economy to reduce the funds with people will not rein in inflation.

Given the short deadline associated with this policy, our analysts at Rate Captain believe that the high volume of money outside the banking system may put pressure on the naira. This is because people who have accumulated the naira illegally will start using them to buy foreign currencies, as taking the monies to the bank may expose their illicit perpetration. this may further drive down the value of the naira.

Nevertheless, returning old notes to the banks is a good way to withdraw the money in circulation into the banking system. This will give the CBN the luxury of regulating the circulation of the new notes outside the banking system.

Take a look at the cost of depositing money above N150,000: Existing policy establishes that if you pay more than N150,000 into your bank account, you would pay charges but given the directive by the apex bank to return old notes, this existing policy is suspended. What this means is that even if you want to pay 1 billion or 10 billion into your account, you will not be charged any money.