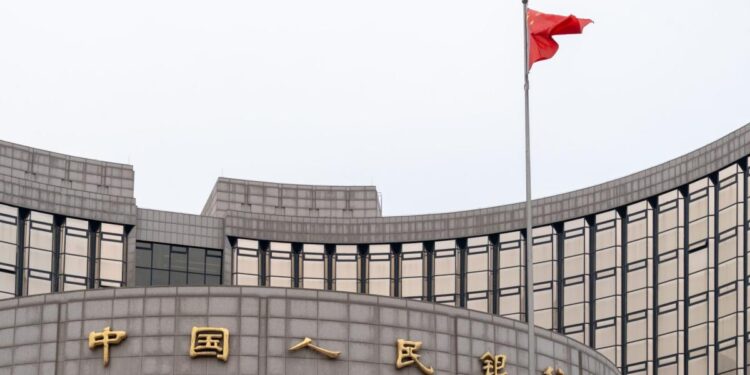

China’s central bank, the People’s Bank of China (PBOC), has reduced its key benchmark lending rates by 25 basis points, a move aimed at stimulating the country’s slowing economy. Announced on Monday, the one-year loan prime rate (LPR) was lowered to 3.1%, while the five-year LPR was cut to 3.6%. These rates influence corporate and household loans, with the five-year LPR acting as a benchmark for mortgage rates.

The rate cut, which was anticipated following comments from PBOC Governor Pan Gongsheng, is part of China’s broader efforts to ease monetary conditions. Pan had indicated during a forum in Beijing that the central bank would lower rates by 20 to 25 basis points. He also hinted that the reserve requirement ratio (RRR)—the amount of cash banks must hold—could be reduced by another 25 to 50 basis points by the end of the year, depending on liquidity needs.

In addition to these cuts, the seven-day reverse repurchase rate will be reduced by 20 basis points, and the medium-term lending facility rate by 30 basis points.

While the LPR cuts were expected, economists have pointed out that monetary easing alone may not be enough to address China’s economic challenges. Shane Oliver, head of investment strategy at AMP, noted that while the reduction is a positive step, it does not tackle the core issue of weak demand. He stressed the importance of fiscal stimulus to boost the economy.

Despite multiple rate cuts, the real interest rate in China remains high, according to Zhiwei Zhang, president of Pinpoint Asset Management, who expects further rate cuts next year as U.S. Federal Reserve rates decline.

This latest move follows a 50-basis-point reduction in the reserve requirement ratio last month, part of a series of measures designed to bolster the world’s second-largest economy. China is grappling with a prolonged property sector crisis and weak consumer confidence, which have been weighing on growth.

While China’s economic data showed some positive signs last week—such as a better-than-expected 4.6% GDP growth in the third quarter and stronger retail sales and industrial production in September—experts say that more comprehensive support will be needed to ensure sustained recovery.