While cash flows from China are helpful in actualising the huge infrastructure development agenda of the current administration, unless the country keeps faith with the repayment terms, the likelihood of losing the infrastructure to China is high as the Sri Lankan and Zambian examples have shown.

After its valedictory meeting last Wednesday, the Federal Executive Council (FEC) intimated the country of the request by the Federal Government for a fresh $1.8 billion loan from the China Exim Bank for the construction of a coastal rail line. According to the Transport Minister, Mr Rotimi Amaechi, who disclosed this during a press briefing, the Federal Government will pay $500 million as counterpart fund for the $2.3 billion project.

The current administration has not hidden its plan to improve the nation’s infrastructure, which it believes will result in job creation and economic revitalisation, and has resorted to taking foreign loans to actualise this due to the dire financial strait in which it has found itself. Already, the Kaduna-Abuja rail project has been completed, new terminals have been built at the Nnamdi Azikwe International Airport, Abuja and Port Harcourt International Airport, the Lagos-Ibadan rail project is nearing completion, and many other infrastructure interventions are ongoing in different parts of the country.

However, the nation’s rising debt profile has been a source of worry to many Nigerians who are concerned about the nation’s propensity for amassing debts because the country is so indebted that currently over 60 per cent of the nation’s budget goes into debt financing. Although the government has insisted that the country’s debt stock figure, which is between 20 and 23 per cent of the Gross Domestic Product (GDP) is sustainable, not many Nigerians are convinced because of the country’s low level of productivity.

Not too long ago, the Deputy Secretary-General of the United Nations, Mrs Amina Mohammed, condemned the country’s seeming uncontrollable appetite for foreign debts. Mrs Mohammed, who served as Minister of Environment in the current administration before bagging the UN job, said Nigeria was steadily returning to its unwholesome past of heavy debt overhang, lamenting that while former Finance Minister, Ngozi Okonjo-Iweala, freed the country from a huge debt burden, the current leaders are accumulating debts. Similarly, Professor Kingsley Moghalu, a former Deputy Governor of the Central Bank of Nigeria (CBN), said that piling up debts by the country would only end in a sorry tale as history had revealed that reliance on foreign loans had not contributed to the growth of the nation’s economy.

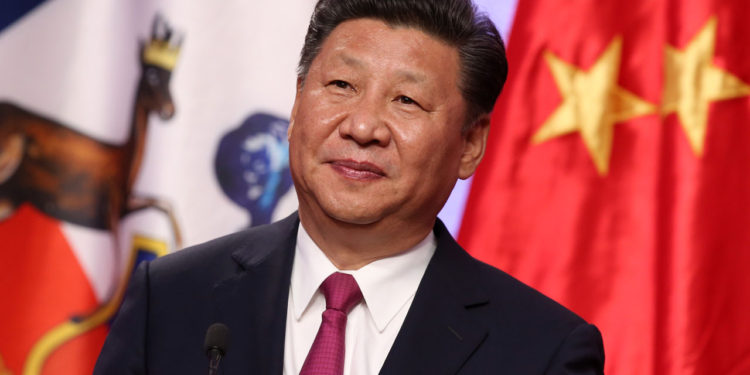

Not a few Nigerians are particularly worried about the country’s rising indebtedness to China. Although many of the borrowings from the Asian country are done through China Export-Import (Exim) Bank, which offers concessionary loans at low-interest rates and with long maturity periods, the concerns of Nigerians are rooted in the fact that unlike Western creditors and Multilateral Development Banks (MDBs), China does not grant debt relief when a debtor nation fails to meet the repayment terms. So, they are worried that Nigeria may lose some of her valuable assets to China in the case of payment default. Many experts have even referred to President Xi Jinping’s Belt and Road Initiative as a debt trap for vulnerable countries.

The International Monetary Fund (IMF) confirmed the fears of many Nigerians recently when it counseled Nigeria and other developing countries to be cautious of loans from China as a result of the unfavourable loan terms.

While acknowledging that capital flows, including those from China are critical for development, IMF, through its Financial Counsellor and Director of the IMF’s Monetary and Capital Markets Department, Mr Tobias Adrian, advised countries to take loans that conform with Paris Club arrangements, adding “that is not always the case of loans from China.”

The Debt Management Office (DMO), in its reaction to the IMF counsel, said the Federal Government opted to borrow from China so as to diversify the sources of its borrowed funds and in order to take advantage of a cheaper source of finance.

The DMO said, “Given the country’s infrastructure deficit, which needs to be urgently addressed, the loans from China Exim, which provide financing for critical infrastructure in road and rail transport, aviation, water, agriculture and power at concessional terms, are appropriate for Nigeria’s financing needs and align properly with the country’s Debt Management Strategy.”

The DMO also assured Nigerians that with the public debt being well managed under statutory provisions and international best practices, there would not be any case of default, thus there would not be any need for a takeover of assets by China.

Taking the argument further, Mr Rotimi Amaechi, Transport Minister, said two weeks ago at the 6th Annual East African Transport Infrastructure conference held in Nairobi, Kenya, that the Federal Government did not mortgage any property to secure loans from China, so the case of losing property to the Asian country does not arise.

The Minister explained that the need to pledge any property for the loans did not arise because the country had the capacity and intention to repay its loans.

Amaechi said, “I do not think we will have any problems with repaying our loans…There are some countries that have not been able to repay their loans. So what China is doing is that, it is taking over to manage and get its money, but it’s not so in Nigeria.”

The Minister added, “We are talking with them, to say that by June, we should be able to say this is our repayment plan. It also depends on what agreement plan you have with them. Our agreement does not include the fact that they will come and take over our seaports or railways or airports.

“We believe that we can pay back using our own money. That shouldn’t be any problem. Our focus should be to run this infrastructure efficiently so we can pay back and there is no plan for them to manage any of it.”

However, the revelation by Amaechi while addressing journalists at the valedictory press briefing last week has heightened the fears of Nigerians on the country’s fidelity to the Chinese loan terms and the consequences of payment default. The Transport Minister had said that despite his directive to the management of the Nigeria Railway Corporation to put up a sinking fund and an escrow account for the repayment of the $500 million loan taken from China Exim Bank in accordance with the loan terms, the organisation had yet to comply with this.

According to Amaechi, the Chinese had insisted during negotiation for the facility that the two accounts be opened for the purpose. He said China had requested that the repayment funds should go to the sinking account on a yearly basis while those for the running of the railway be domiciled in the escrow account.

The minister disclosed that Nigeria had yet to commence repayment of any of the loans taken from China despite the commencement of full commercial operations on the Abuja-Kaduna rail corridor and an improved revenue generation of about 400 per cent recorded by the Nigerian Railway Corporation in 2018.

Amaechi said of the NRC management, “They know I am going and that I may not come back. But I want the Permanent Secretary to hold him (the MD) to that instruction. The instruction was that all the money they realise from the Abuja-Kaduna railway should be kept in an account with the cost of operations deducted while the balance is used for the repayment of the loan.”

If operators and managers of the infrastructure for which loans were taken from China do not keep to the terms of the loans how will the country not fall into payment default?

The Sri Lanka example

Former Sri Lankan President, Mahinda Rajapaksa, planned to improve the operation of Hambantota Port, and sought a loan for this from China. The Chinese authorities released the funds and the project commenced. Sri Lankan government later realised it would need more money to complete the port, it turned again to China to get more money. At the end of the day, it was indebted to China to the tune of $8 billion. However, the port could not attract the kind of patronage that would make repayment of the loan possible. Then China piled pressure on Sri Lanka to meet its debt obligations. When the country could not do this, it had to hand over Hambantota, its most important port as well as 15,000 acres of land around it to China to manage for 99 years to recoup its money.

The Zambia example

Zambia owes a third of its foreign debts to China. Chinese funds were used to retune the Kenneth Kaunda Airport, the Zambia National Broadcasting Corporation, ZESCO, the electricity company, and many others. Failure of Zambia to meet its repayment obligations to China Exim Bank has resulted in some of the assets being relinquished to the Asian country for a period of time. China has already taken over ZNBC. Apart from the editorial policy of the network, everything else is managed by Star Times owned by Chinese interests. All cash payments that have to do with ZNBC are made to Star Times. Then Star Times is also in charge of the signal and has been empowered to license local operators. That arrangement will last 25 years to allow China recover the $273 million it loaned the country to achieve digital migration. Discussions are underway concerning the eventual takeover of both ZESCO and the Kenneth Kaunda Airport by Chinese companies as the country has repeatedly defaulted on loan repayment. Pushed to the wall to repay its debts to China, Zambian authorities have been diverting donor funds meant for social sector spending to debt repayment, a situation that forced the United Kingdom’s DFID to suspend funding to the Ministry of Education.

So, unless Nigeria emplaces a water-tight system that will ensure repayment of the debts when they are due, it may find itself in a situation where it would cede some national assets to China to offset the debts.