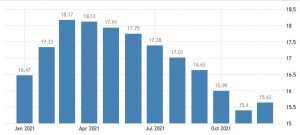

Inflation rate in Nigeria has been on an isogenous month on month decline since March 2021. However, according to the NBS, Nigeria’s consumer price index dilated marginally by 15.63% year-on-year in December 2021. The rise in inflation figures was copiously correlated to increases recorded in the two components of the consumer price index. Food index increased from 17.21% in November to 17.37%.

Why Analysts and the Federal Government needs to take Inflation Rate Pensively

As the National Bureau of Statistics continues to announce month on month inflation rate in Nigeria, you might wonder, what are the implications of these actions? Has the NBS monthly CPI announcement become a mere obligation to save face? Or just to meet international demand for economic data to generate revenue.

According to Economic analyst Omosuyi Temitope “First, the NBS reported that headline inflation jumped by 1.8% month-on-month. Consequent upon this, most forecasters got the predictions wrong as their analyses were mostly based on the empirical evidence that headline inflation, on month-on-month, usually hovers around 1%, but could inch up to 1.6-1.7% if there are major and obvious shocks to commodity prices such as COVID, Endsar protests, border closures, and significant currency depreciation/devaluation. “

“Sadly, analysts would be compelled to unreasonably attribute this spike to existential and age-long threats to commodity prices, even though they are as surprised as I am. In fact, no one can claim it was due to the high demand in December, as this was not the case in previous years (Decembers are not outliers!).”

“I really hope CPIs will not become random numbers but that price trends can be clearly linked with economic events. In the meantime, I remain committed to providing insight beyond a casual glance!”

Recall, Rate Captain previously published research on the importance of money supply to the Nigerian economy, This further highlights the importance of estimates that determines inflation statistics in the economy. Sadly, analysts has failed to create awareness around this critical variable.

Meanwhile, in the United States, investors in the commodity market adjust trading level ahead of the monthly U.S inflation data report released by the US Labor Department, This consequently affects prices and demand or supply structure of commodities in the market.

In a densely populated country like Nigeria, Demand power is extremely high for consumer goods ,this has been one of the most consistent causes of inflation in the economy. Therefore, the government as well as economic analysts must to their very best to highlight macro-economic indicators and initiate economic policies to curb the problem of inflation in Nigeria.

Author: Ayeni Samson