The Managing Director of the International Monetary Fund, Kristalina Georgieva, has cautioned about the unforeseeable “consequences” that could be brought about by the retail central bank digital currencies.

Georgieva expressed her concern about retail CBDCs in a May 1 interview at the Milken Institute’s 2023 Global Conference.

According to the IMF boss, the IMF considers retail CBDCs to have far more room for error than wholesale CBDCs.

She said, “We think that wholesale CBDCs can be put in place with fairly little space for undesirable surprises, whereas retail CBDCs completely transform the financial system in a way that we don’t quite know what consequences it could bring.”

According to a report by Cointelegraph, retail CBDCs are state-backed virtual currencies issued by central banks for use by consumers and businesses while wholesale CBDCs are similarly central bank-issued but are designed to allow financial institutions to carry reserve deposits with a central bank.

The IMF MD noted that the organization was collaborating with about 50 countries to ensure best practices are adopted, which she expects to have a huge influence on banks and economies in the future.

Earlier, the IMF had announced that it would publish a CBDC handbook to help central banks with CBDC design and implementation, a decision resulting from the unprecedented levels of interest from nations around the world.

On Tuesday, the CBN governor disclosed that e-Naira transactions hit about N1.4m as of March 31, 2023.

Emefiele, who was represented by the Director, of Policy, of the CBN, Dr Hassan Mahmoud, said that his team took advantage of COVID-19 and other developments in-country to drive the electronic payment channels.

He said, “The advent of the Corona Virus pandemic no doubt triggered rapid advancements in financial technology leading to speedy digitisation of money and finance.

On Tuesday, the CBN governor disclosed that e-Naira transactions hit about N1.4m as of March 31, 2023.

Emefiele, who was represented by the Director, of Policy, of the CBN, Dr Hassan Mahmoud, said that his team took advantage of COVID-19 and other developments in-country to drive the electronic payment channels.

He said, “The advent of the Corona Virus pandemic no doubt triggered rapid advancements in financial technology leading to speedy digitisation of money and finance.

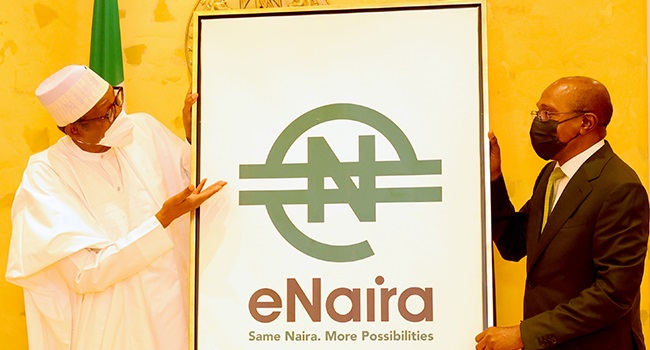

“The CBN took advantage of the opportunity by launching the eNaira in October 2021. The eNaira was developed to broaden the payment possibilities of Nigerians, foster digital financial inclusion, with potential for fast-tracking intergovernmental and social transfers.

“Since its launch, the CBN has continued to modify its features to make it more accessible to a wide range of users.

“Today, one does not need a smartphone to use the eNaira as it has become compatible with all generations of mobile devices (old and new). Till date, over N1.4m transactions have passed through the eNaira platform.