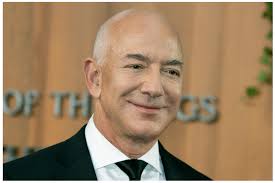

In a strategic move, Jeff Bezos, the renowned founder of Amazon.com Inc., has undertaken a significant divestment by selling 12 million shares of the company, marking his first stock sale since 2021. The transactions, which occurred on Wednesday and Thursday, amounted to just over $2 billion, as indicated by regulatory filings.

Bezos had previously announced his intention to sell up to 50 million Amazon shares over the next 12 months, leveraging the recent surge in the company’s stock value. This surge has brought him closer to securing the title of the world’s richest person, with his fortune growing by $22.6 billion in 2023 alone, reaching an impressive $199.5 billion according to the Bloomberg Billionaires Index.

This latest divestment adds to Bezos’ history of selling Amazon shares, with total sales exceeding $30 billion since records began in 2002. Notably, he engaged in substantial sales in both 2020 and 2021.

Despite these divestitures, Bezos maintains a consistent commitment to stock philanthropy. In November, he made a significant contribution by donating approximately $230 million worth of Amazon shares to various nonprofit organizations.

Bezos’ strategic approach to wealth management and philanthropy is evident in his ongoing divestment of Amazon shares. This allows for prudent portfolio diversification while providing substantial resources for his philanthropic initiatives, such as the Bezos Earth Fund, focusing on addressing climate change, and the Day 1 Families Fund, targeting homelessness and education.

Although Bezos has stepped down from his role as Amazon’s CEO, he continues to wield significant influence within the company and remains deeply involved in various ventures. Notably, he is actively engaged in Blue Origin, his private aerospace manufacturer and spaceflight services company.

Bezos’ multifaceted approach to wealth management showcases his commitment to both strategic financial planning and impactful philanthropy as he navigates the dynamic landscape of his post-Amazon era.