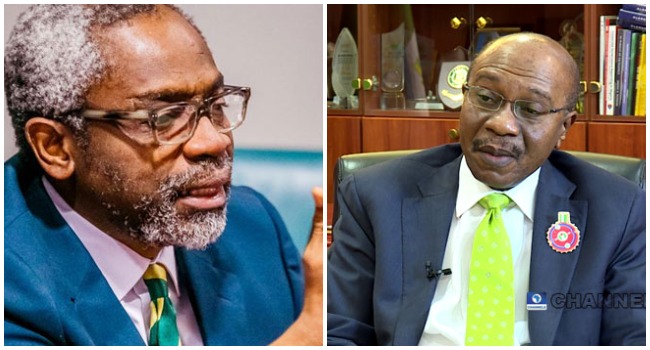

The Central Bank Governor (CBN), Godwin Emefiele, appeared before the ad-hoc committee of the House of Representatives, which is investigating the scarcity of the new naira notes.

The scarcity of the new notes forced the House of Representatives to set up an ad-hoc committee to resolve the difficulties between the CBN and commercial banks, despite the insistence of Emefiele that many of the banks were hoarding the notes. Emefiele had failed to appear before the lawmakers despite initial requests detailing in a series of letters that he was in the United States on an important assignment.

Speaker of the House, Femi Gbajabiamila, was to issue a warrant for Emefiele’s arrest over his repeated failures to answer at least four summons from the House. The House had shelved its plan to go on break for the presidential and National Assembly elections, which were to commence on Thursday, over the CBN governor’s failure to answer the last summons issued to him by the committee.

Gbajabiamila had threatened to mandate the Inspector-General of Police, Usman Baba, to arrest and force his appearance before the panel, insisting that the deadline breached the provision of Section 20(3) of the CBN Act.

Mr. Emefiele, while addressing the committee, explained that he had been out of the country thats why he was not able to honour previous invitations.

Speaking about the redesign of the naira, he said the CBN’s actions were in line with international best practices and the apex bank had to be in control of the currency in circulation. Mr. Emefiele said in 2015, N1.4 trillion was in circulation, and by last year, it had risen to N3.33 trillion.

He explained that the reason for directing banks to allow only ATM withdrawals was to limit the daily withdrawals of individuals. The CBN boss decried the trend of the new notes being sighted at parties and stated he was in meetings with commercial banks to mitigate them.

Godwin Emefiele acknowledged that the policies would hurt some people but claimed it was in the interest of the country, especially in combating financial insecurity.