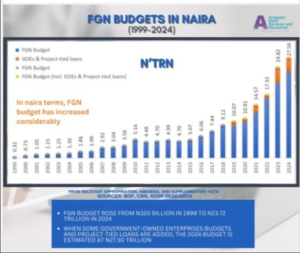

In a stark illustration of the economic challenges facing Nigeria, the Federal Government’s budget has seen a significant surge in naira terms but has encountered a decline when expressed in dollars. The proposed 2024 budget of N27.50 trillion represents a notable increase from the N320 billion budgeted in 1999, reflecting the growth and evolving needs of the nation.

However, a closer look reveals a concerning trend when viewed through the lens of the exchange rate. The proposed 2024 budget, when converted to dollars, stands at approximately US$33.10 billion. This falls short of the 2023 budget, which was valued at $41.30 billion, underlining a contraction in the government’s financial capacity when measured in the global currency.

Analysts point out that when adjusted for factors like government-owned enterprises (GOEs) budgets and project-tied loans, the 2024 budget is only marginally higher than the 2008 budget. This suggests a nuanced picture where the apparent growth may be offset by various economic considerations and debts.

The weakening of the naira is identified as a key factor contributing to this discrepancy. Not only is it adversely affecting importers by increasing the cost of goods and services, but it is also having a direct impact on the size of the government’s financial footprint. The reduced value of the naira in the international market is diminishing the purchasing power of the government and limiting its ability to execute ambitious projects and initiatives.

Economic experts argue that this scenario underscores the imperative for Nigeria to enhance its productivity and economic resilience. Calls for measures to stabilize and strengthen the naira are gaining momentum, with emphasis on diversifying the economy, attracting foreign investments, and implementing policies to ensure a more robust and stable currency.

As Nigeria grapples with these economic challenges, there is a growing consensus that a comprehensive and strategic approach is necessary. Addressing the currency devaluation, boosting productivity, and fostering a favorable business environment are seen as critical steps to ensure sustainable economic growth and the realization of the nation’s developmental goals. The onus is now on policymakers and stakeholders to navigate these challenges and steer Nigeria towards a path of prosperity and financial stability.