Source: RateCaptain

The considerable depreciation of the Nigerian naira is intricately tied to a series of global economic shocks, most notably the reverberations of the COVID-19 pandemic in 2020 and the geopolitical tensions arising from the Russia-Ukraine war in 2022. These external forces set off a chain reaction, leading to unfavorable consequences such as heightened inflation, increased interest rates, and escalated costs of imports. Adding to the complexity, stringent domestic foreign exchange (FX) policies, characterized by import restrictions, compounded by limited dollar inflows in Nigeria, have substantially contributed to the erosion of the national currency’s value.

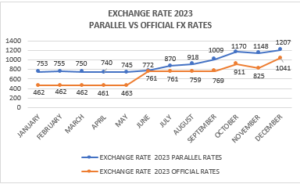

Examining the specific dynamics of the exchange rate, the period between January 2023 and December 2023 witnessed a significant decline in the naira, plummeting from 462 Naira per US dollar to 1041 Naira per US dollar at the official market. This represents a staggering 66% loss in the official exchange rate from 2020 to 2023. Concurrently, the parallel market, commonly referred to as the black market, recorded a current dollar exchange rate of N1,207, compared to N755 earlier in the same year.

Economic Shock-Inflationary Pressure

Source: Ratecaptain

Adding to the economic challenges, Nigeria’s inflation rate soared to a more than 18-year high in November, primarily driven by rising energy and food prices. The annual inflation rate climbed to 28.05%, up from 21.92% in January 2023, marking the highest level since August 2005. This surge, exceeding economists’ estimates, has compounded concerns about the Naira’s strength. The persistent rise in inflationary pressure has adversely impacted the cost of production, weakened profitability, eroded shareholder values, and dampened investor confidence. These factors collectively contribute to reduced production, declining exportation, the departure of foreign investors, and an increase in importation, consequently diminishing the country’s external reserves a significant factor influencing the devaluation of the Naira.

Market Disparities-Parallel Vs Official Rate Paradox

Another critical factor exacerbating the FX crisis is the glaring disparity between the parallel market and the official rate, attributed to market manipulators. In response to this challenge, the Governor of the Central Bank of Nigeria (CBN) has initiated measures to achieve FX rate convergence. This strategic move involves aligning and approaching various exchange rates for the Naira toward a single unified rate, recognizing the coexistence of multiple exchange rate markets, including official and parallel rates in Nigeria. The overarching goal of convergence is to minimize the gaps between these rates, fostering enhanced exchange rate stability and curtailing opportunities for arbitrage.

The unification of the exchange rate is anticipated to empower the CBN to more effectively manage crucial economic indicators such as inflation, interest rates, and liquidity. However, despite ongoing efforts to liberalize exchange rates, a persistent gap remains between the parallel market and the official market, presenting an enduring challenge to achieving complete convergence. This incongruity underscores the complexity of Nigeria’s foreign exchange landscape, necessitating continued strategic interventions to address the multifaceted issues impacting the Naira’s value.

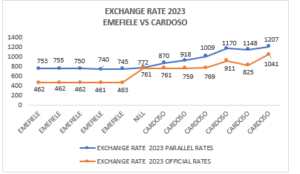

COMPARING NAIRA DEPRECIATION BETWEEN EMFIELE AND CARDOSO

Source: Ratecaptain

The value of the Naira against the US Dollar has witnessed a notable journey, particularly during the tenure of Governor Godwin Emefiele from March 2014 until his suspension. The official exchange rate, a crucial indicator of economic health, experienced a significant depreciation, falling from N164 to N461 a stark decline of over 61%. Moreover, in the parallel market, where market dynamics often reveal a nuanced reality, the Naira weakened even further, plummeting from N180/$ to N745/$, signifying an alarming depreciation of over 70.5% over the span of a decade.

The decline in the official rate and the more pronounced depreciation in the parallel market during Emefiele’s leadership highlight the challenges faced in maintaining the stability of the Naira. Concurrently, the foreign reserves of the nation faced a decline, diminishing from $44.3 billion to $37.9 billion. This points towards the broader economic challenges encountered, including pressures on the foreign reserves and potential impacts on the country’s overall financial stability.

However, in a significant turn of events, September 2023 witnessed a notable transition in leadership at the Central Bank of Nigeria (CBN). Godwin Emefiele’s resignation, three months after his suspension by President Bola Tinubu, paved the way for Olayemi Cardoso to assume the position of CBN Governor. The swift nomination and approval of Cardoso reflected a commitment to steering the country’s economic ship through turbulent waters.

Cardoso wasted no time in initiating reforms to address the prevailing economic challenges. One of his foremost actions was the unification of FX rates, eliminating disparities between the parallel market and the official market, effectively creating a single market. This move aimed to bring about much-needed consistency and transparency in the foreign exchange system.

Moreover, Cardoso tackled the issue of FX backlog, a long-standing concern that had been contributing to the instability of the Naira. By clearing the backlog, he sought to instill confidence in the market and stabilize the national currency.

Beyond these immediate challenges, Cardoso implemented a comprehensive set of reforms. Regular Open Market Operations were introduced to manage excess liquidity, and adjustments were made to treasury bills issuance, deposit structures, and the Cash Reserve Ratio. These reforms collectively aimed at fortifying the financial system, enhancing liquidity management, and fostering economic stability. In the Oversight, these reforms are yielding the foreseen result but businesses and homes are yet to see significant improvements. The naira continues to crash against other currencies, exchanging officially at N1041 to $1 and at N1207 to $1 at the parallel market in recent times.

While these initiatives signal a proactive approach to address the challenges inherited from the previous administration, the success and impact of these reforms will require continued observation and assessment. The complexities of economic management demand not only swift policy changes but also adaptability and resilience to navigate an ever-evolving global economic landscape.

WORLD BANK LOANS TO BOOST NAIRA APPRECIATION

President Bola Tinubu has led Nigeria to successfully secure $2.7 billion in loans from the World Bank in 2023. These funds are designated to support economic reforms in key areas such as exchange rates, trade, and export promotion policies. A portion of the loans will be channeled to Nigerian importers requiring foreign exchange, facilitated by the newly established Second-Tier Foreign Exchange Market (SFEM) that commenced operations on September 29. The primary objectives of this initiative are;

Increased Foreign Exchange Supply: By directing a portion of the loans to Nigerian importers in need of foreign exchange, the SFEM aims to increase the supply of foreign currency in the market. This increased supply can help meet the demand for foreign exchange and stabilize or strengthen the Naira against other currencies.

Market-driven Exchange Rates: The economic reforms, particularly in the exchange rate policies, suggest a move towards market-driven exchange rates. Allowing the market to play a more significant role in determining exchange rates can contribute to a more transparent and efficient foreign exchange system, potentially supporting the Naira.

Economic Reforms and Diversification: The broader reform program, which focuses on enhancing economic efficiency and reducing dependence on oil, aims to diversify the Nigerian economy. Diversification can lead to a more balanced and resilient economy, reducing vulnerabilities associated with fluctuations in oil prices. A more stable and diverse economy can positively impact the value of the Naira.

Mitigation of Decline in National Income: By addressing the decline in real national income resulting from the significant decrease in oil prices, the initiative aims to stabilize the overall economic condition. A stabilized economy can instill confidence in investors and strengthen the Naira.

IMPACT DANGOTE OIL REFINERY ON NAIRA VALUATION

Source: Trading Economics

In the complex web of Nigeria’s economic dynamics, the impending operationalization of the Dangote Refinery stands as a transformative force, poised to reshape the country’s petroleum sector and, by extension, its overall economic outlook. The focus of this analysis revolves around the expected impact of the Dangote Refinery on crude oil importation demand and the broader implications for Nigeria’s economic resilience.

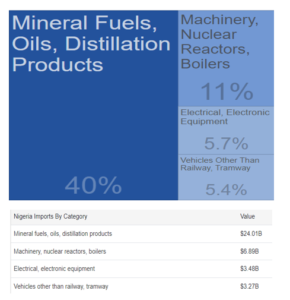

- Addressing Import Dependency

Nigeria, currently importing over 80% of its refined petroleum products, holds the position of being the largest importer in Africa. The Central Bank of Nigeria reports a doubling of petroleum product import costs from US$8.4 billion in 2017 to US$23.3 billion by end-2022, contributing to the depreciation of the Naira. The Dangote Refinery is anticipated to play a pivotal role in significantly increasing local refinery capacity, aiming to meet 100% of Nigeria’s refined petroleum product needs. The refinery’s daily production estimates, including gasoline, diesel, kerosene, and aviation jet fuel, indicate a potential surplus for export markets.

Dangote Refinery’s production capacity is poised to address supply shortfalls and eliminate import dependency, potentially reducing the impact of global events on local fuel availability.

- Foreign Exchange Reserves Boost:

The Central Bank of Nigeria foresees substantial foreign exchange savings, ranging from US$25 billion to US$30 billion annually, attributable to the Dangote Refinery. As the refinery produces more fuel domestically, it lessens Nigeria’s dependence on imported fuel, generating significant foreign exchange earnings from the export of refined petroleum products.

- Enhancing Currency Stability:

Nigeria’s external reserves, currently standing at around $35 billion, represent six months of imports only. The increased reserves from Dangote Refinery’s operations can fortify the country’s ability to support its currency and manage exchange rate fluctuations. A robust reserve position acts as a cushion against external shocks, instilling confidence in the stability of the Naira and attracting foreign investors, potentially leading to additional foreign capital inflows.

- Transition to Net Exporter

Traditionally an importer of refined petroleum products, Nigeria has the potential, with Dangote Refinery, to transition into a significant exporter. Exporting excess refined products, especially to African countries, can generate foreign exchange earnings, increase dollar supply, and contribute to the stability and strength of the Naira.

Increased dollar supply from refined petroleum exports can stabilize or strengthen the Naira, fostering investor confidence in Nigeria’s economic landscape. A strengthened Naira enhances Nigeria’s attractiveness to foreign investors, potentially leading to sustained capital inflows and further currency stability.

A Paradigm Shift in Nigeria’s Economic Landscape

The anticipated commencement of operations at the Dangote Refinery marks a pivotal moment in Nigeria’s economic journey. Beyond transforming the petroleum sector, the refinery is poised to lessen import dependency, bolster foreign exchange reserves, and potentially position Nigeria as a net exporter of refined petroleum products. As the country navigates the challenges of global economic dynamics, the Dangote Refinery emerges as a beacon of economic resilience, promising a paradigm shift towards self-sufficiency and stability.

Bottom Line:

The ongoing efforts towards FX rate convergence aspire to create a unified market, yet the lingering gap underscores the intricate challenges facing the Naira, echoing the need for strategic interventions.

Amid these challenges, a glimmer of hope emerges with the infusion of $10 billion into the Ministry of Finance and the financial support from the World Bank. These funds carry the promise of easing FX constraints, instilling stability, and fortifying ongoing economic reforms. However, the effectiveness of these measures hinges on vigilant monitoring, given the fluid nature of the global economic landscape.

Simultaneously, the impending commencement of operations at the Dangote Refinery signals a potential inflection point. Despite their production limitations, these refineries offer a lifeline to Nigeria’s heavy reliance on crude oil imports.