The Federal Government of Nigeria has obtained a $134 million loan from the African Development Bank to boost wheat production.

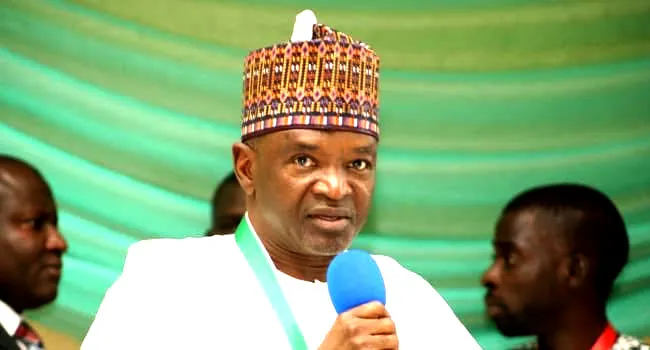

This was disclosed by Dr. Muhammad Mahmoud, the Minister of Agriculture and Rural Development, who said in Abuja while commenting on the implementation of the presidential mandate given to the ministry.

Last month, the Board of Directors of the African Development Bank Group approved the loan for the National Agriculture Growth Scheme – Agro Pocket Program in Nigeria to scale up food production and boost livelihood resilience.

This wheat production loan came at a very strategic time as Russia’s invasion of Ukraine and the resultant disruption to the supply of wheat have led to shortages of the commodity in the global market, causing a spike in its price. Rate Captain had previously reported how the Russia-Ukraine war is having a direct pass-through effect on the rising domestic food prices in Africa, given that the continent imports over 70% of wheat from either of the two countries.

According to AFDB, Nigeria’s inadequate support for the farmers has confined them to traditional agronomic techniques, resulting in low productivity and limited opportunities for value addition. In 2020, the harvested cereals area and yields declined by 2.75% and 1.5%, respectively.

What the Minister is Saying

According to premium times, the minister noted that the initiative would raise wheat production to 750,000 metric tonnes as 250,000 farmers are set to cultivate 250,000 hectares in the 2022 dry season. The 5,000 agro rangers deployed from the Nigeria Civil Defence Corps would help protect farmers facing security challenges.

Dr. Muhammad Mahmoud said, “the wheat would be cultivated in Jigawa, Kebbi, Kano, Bauchi, Katsina, Kaduna, Sokoto, Zamfara, Gombe, Plateau, Borno, and Yobe, Adamawa, and Taraba states.”

- “About 3.6 million indirect jobs had been created from the $2.4 billion worth of externally-funded projects being implemented by the Buhari administration.”

- “$538 million was approved for special agricultural processing zones to support inclusive and sustainable agricultural development in Nigeria.”

The Nigerian minister also noted that another project worth $575 million is being implemented to improve rural access and agricultural marketing in participating states.

- “He also said the government was implementing the Value Chain Development Programme Additional Financing (VCDP) 2020-2024. This is to enhance incomes and food security of poor rural households engaged in the production, processing, and marketing of rice and cassava.”

- “Agro-Climatic Resilience in Semi-Arid Landscapes Project, a $700 million project with a six years duration (2022 to 2028), is being implemented by three ministries; Environment, Agriculture, and Water Resources. The 19 states in the northern part of the country and the FCT are the beneficiaries.”

Dr. Mahmoud, having acknowledged the Russia-Ukraine war as the major cause of the shortages of wheat and a contributor to the slowing down of the global economy, said Nigeria is significantly not experiencing a food crisis.

According to NAN, the minister also commented that the government’s foresight in introducing measures to ward off the effects of COVID-19 and the Russia-Ukraine conflict had paid off.