Nigeria and two other African countries have been selected to benefit from the Belt and Road Initiative (BRI) in excess of $100 billion.

The BRI, an initiative of the Chinese government, offers an infrastructural development and investment opportunities in over 60 countries across Europe, Asia and Africa.

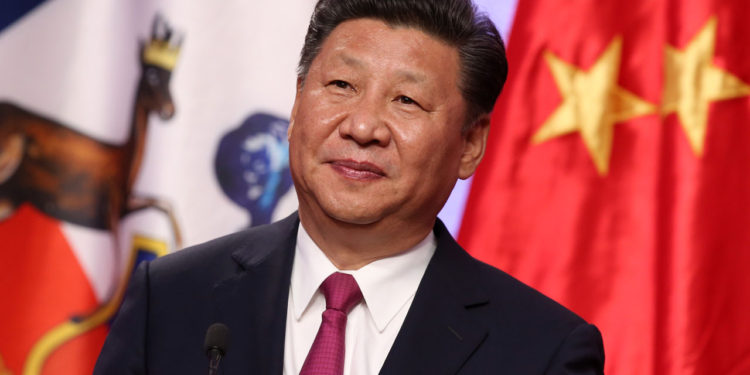

The international support scheme was designed by the Chinese President, Xi Jinping, in 2013, as One Belt and One Road Initiative, which in 2016 was changed to BRI.

At a forum on “the Belt and Road Initiative and production capacity co-operation between China and Nigeria”, recently in Lagos, emphasis was laid on BRI, as an avenue to revitalise Nigeria business sector and impact positively on the country’s ailing economy.

The BRI, it was gathered, had created a major international financial institution, the Asian Infrastructure and Investment Bank (AIIB) with solid capital base of $100 billion to finance infrastructure and other related projects in Asia and other member nations.

For instance, one of the beneficiary nations, Pakistan, through BRI was able to enter into $62 billion of projects scheduled along the China-Pakistan Economic corridor. The investment worth is equivalent to 21 per cent of Pakistan’s Gross Domestic Product (GDP), which has not only yielded dramatic long-term impact on her domestic economy and businesses, but has also been able to move up its energy capacity to 9,000 MW representing 50 per cent increase in the country’s energy to woo investors.

At the forum, the Vice Chancellor, Nnamdi Azikiwe University, Prof. Joseph Ahaneku disclosed how students from his institution bagged scholarship through China’s benevolence.

Ahaneku lauded the vast opportunity BRI has made available for students and expressed the university’s readiness to continue leveraging on those areas with a view to strengthening its ties with China for the benefit of the students.

Vice Chancellor, University of Lagos, Prof. Oluwatoyin Ogundipe, also lauded BRI and commented the presence of China in the institution, citing the creation of Confucius Institute, where Chinese Language and culture are taught and promoted.

Ogundipe solicited for a skyscraper of not less than seven floors within the campus, to strengthen the already mutual relationship between the University and the Republic of China.

Governor of Edo State, Godwin Obaseki, in his remarks, disclosed that the BRI has created a platform and opportunity for Nigeria to leverage on.

Obaseki expressed the preparedness of his State to accommodate every development that the Initiative brings, declaring an open door for investment.

Deputy Governor of Ekiti State, Adebisi Egbeyemi, expressed readiness to tap immensely from the benefits of BRI by making adequate preparation for its operation in Ekiti State.

Former Director-General, Nigerian Institute of International Affairs, Dr. Bola Akinterinwa, lauded China for opening her doors for other nations to benefit through the BRI initiative.