Nigerian Banks total assets increased to N65.48 trillion in June 2022, indicative of a 22.07% uptick compared to the N53.64 trillion seen in June 2021.

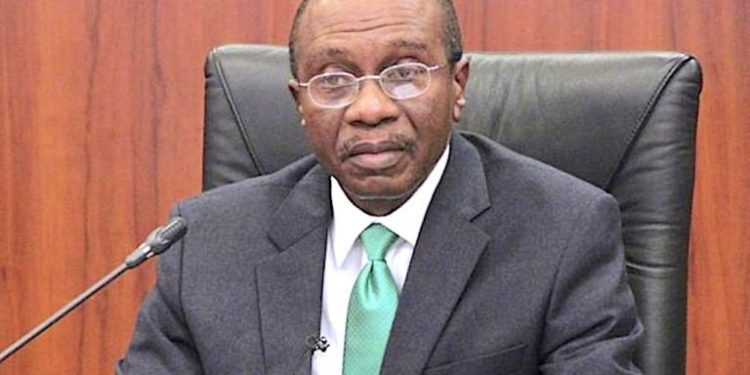

This was disclosed by the Deputy Governor, Financial Systems Stability Directorate, Aishah Ahmad, disclosed this in her statement at the last MPC meeting

She also stated that the total deposits in the banks rose by 24.17 per cent from N33.85tn as of the end of June 2021 to N42.03tn in the corresponding period of 2022.

What the CBN is saying

She said, “Key industry aggregates also continued their year-on-year upward trajectory with total assets rising to N65.48 trillion in June 2022 from N53.64 trillion in June 2021, while total deposits rose to N42.03 trillion from N33.85 trillion over the same period.”

She also stated that bank loans have been on an increasing pace for the past three years. “Gross credit has maintained an upward trajectory since 2019, rising by N5.02 trillion between June 2021 and June 2022 with significant growth in credit to Manufacturing, General commerce and Oil & Gas sectors.”

she added at “this notable increase was achieved amidst a continued decline in non-performing loans ratio from 5.3 per cent in April 2022 to 5.0 per cent in June 2022.

She also stated that the results of stress testing demonstrated the resilience of banks’ solvency and liquidity ratios in the face of potentially catastrophic macroeconomic shocks.

“The Bank must remain vigilant to proactively manage probable macro risks to the financial system such as lingering spillover effects of the pandemic, winding down industry forbearance portfolio, and other risks to financial stability such as exchange rate, operational and cyber security risks,” she added.

What you should know

Nigerian banks‘ borrowings from the Central Bank of Nigeria’s Standing Lending Facility (SLF) increased to N737.05 billion in May 2022, indicative of a N124.62 billion uptick. This is according to the CBN’s latest monthly economic report .

Nigeria’s inflation rate jumped to 20.52% in August 2022, from 19.64% recorded in the previous month. This represents the highest rate since September 2005.

The CBN hiked the interest rate to 14% in July 2022 and the savings deposit interest rate increased to 4.2% from 1.4% to curb rising inflationary pressure as well as encourage FX inflow into the economy.