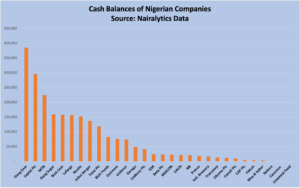

As the final quarter of 2023 unfolds, Nigerian companies are showcasing unprecedented financial resilience, boasting a collective cash reserve of N2.3 trillion. This substantial cash balance marks a notable 27% surge from the N1.8 trillion reported at the close of 2022.

The data, compiled from over 30 major companies listed on the Nigerian Exchange (NGX) from January to December, excludes commercial banks and insurance firms. Despite a challenging macroeconomic backdrop and stringent monetary policies, these companies reported a robust total revenue of N8.05 trillion during the same period.

Source: Nairalytics

Leading the pack in cash reserves are industry giants such as Dangote Cement, Seplat, MTN, and Dangote Sugar. However, it’s worth noting that some companies, while accumulating increased net cash from operations, also resorted to debt financing for sustenance. The total outstanding debt for these companies reached N4.9 trillion by Q3 2023, compared to N3.3 trillion at the end of 2022.

The overall balance sheet size for the companies under review expanded significantly from N13.8 trillion in 2022 to N17.3 trillion in 2023. This growth reflects the impact of various macroeconomic factors, including the depreciation of the naira.

Among the noteworthy insights, only Cadbury, Unilever, CAP Plc, and GSK reported zero debt on their balance sheets. In terms of loan balances, MTN, Dangote Cement, Seplat, and BUA Cement emerged with the largest debts, totaling about N2.9 trillion.

Despite these financial dynamics, the majority of companies recorded a positive net cash flow from operating activities, indicating a successful conversion of sales into cash. This resilience in securing payments from customers amid economic challenges suggests a strong ability to cover operating expenses.

As the Nigerian economy faces uncertainties and a tightening monetary policy, the robust cash reserves serve as a strategic advantage for companies. The surplus cash positions them well to navigate challenges and seize growth opportunities without heavy reliance on debt markets.

Looking ahead to 2024, companies will need to carefully weigh the decision between distributing cash to shareholders as dividends or reinvesting in operations and growth initiatives. The balance struck will play a pivotal role in sustaining performance and capitalizing on potential economic upturns.

Investors, closely monitoring this financial landscape, seek entities demonstrating fiscal prudence and strategic acumen. The significant cash reserves provide a shield against short-term economic turbulence and a platform for long-term strategic investments. Companies adept at managing these reserves may emerge as frontrunners in a stabilizing economy in 2024.