Nigeria’s total public debt rose to N24.947 trillion as at March 31, from N24.387 trillion as at Dec. 31, 2018, growing marginally by 2.30 per cent, the Debt Management Office (DMO) said.

A statement issued by the office on Wednesday in Abuja, said that the debt stock comprises of domestic and external debts of the Federal Government, the 36 States and the Federal Capital Territory (FCT).

It added that the debt which rose by N560 billion was accounted for largely by domestic debt which grew by N458.36 billion, while external debt also increased by N101.64 billion during the same period.

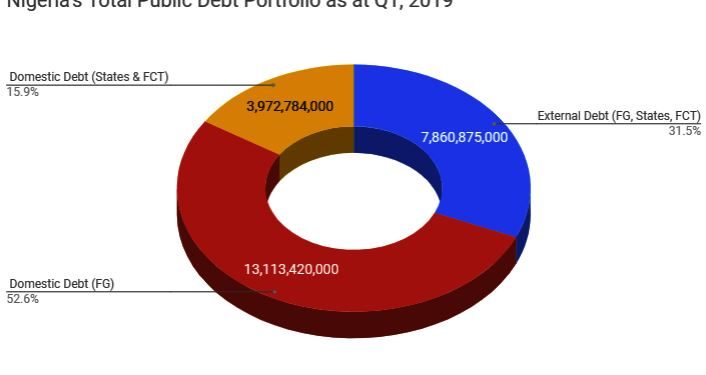

“In relation to the Debt Management Strategy, the ratio of domestic to external debt stood at 68.49 per cent to 31.51 per cent at the end of March.

“The total public debt to Gross Domestic Product (GDP) ratio was 19.03 per cent which is within the 25 per cent debt limit imposed by the government.”

The debt portfolio which was obtained from the DMO website showed that the Federal Government presently owes N13.1 trillion domestically, while the states and the FCT owe N3.97 trillion.

However, the external debt of the Federal Government, States and the FCT stood at N7.8 trillion.

Nigeria’s Total Public Debt Portfolio as at Q1, 2019

According to the states’ debt profile data released by DMO, Lagos recorded the highest domestic debt of N542.2 billion, followed by Rivers with N225.5 billion, Delta N223.4 billion and Akwa Ibom with N199.7 billion.

On the lowest rung are Yobe with N26.9 billion, Anambra N33.4 billion, Sokoto N36.5 billion, Jigawa N38.2 billion and Niger with N43.4 billion.

The data showed that Anambra, Borno, Ebonyi, Ekiti and Lagos profiles as at Dec. 31, 2018, indicated that they had not incurred any domestic debt in 2019.

Meanwhile, that of Rivers was at Sept. 30, 2018.