Investors Pocket N1.7 Trillion as NGX Banking and Industrial Stocks Rally

The Nigerian Exchange Limited (NGX) extended its bullish run on Thursday, February 19, 2026, with investors realising gains of approximately...

The Nigerian Exchange Limited (NGX) extended its bullish run on Thursday, February 19, 2026, with investors realising gains of approximately...

The Nigerian Exchange Limited (NGX) recorded one of its strongest single-day performances on Monday, February 17, 2026, as the benchmark...

The Debt Management Office (DMO) has announced intentions to raise N800 billion from the domestic market through a Federal Government...

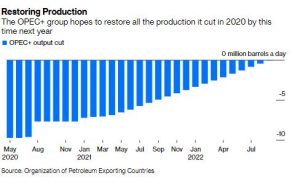

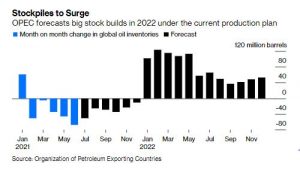

Nigeria’s crude oil production increased to 1.459 million barrels per day (bpd) in January 2026, according to the latest Monthly...

Copyright © 2022 RateCaptain - All rights reserved by RateCaptain.

Copyright © 2022 RateCaptain - All rights reserved by RateCaptain.