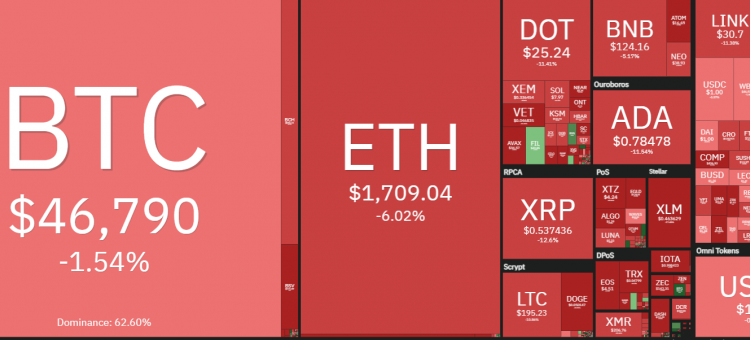

These are surely unpleasant moments for a significant number of crypto investors on the account that roughly $2 billion worth of crypto positions disappeared into thin air within a day.

The mass liquidation of such trading positions, according to data retrieved from Bybt.com, showed such occurred before the flagship crypto dipped around $46,500 today from its all-time high ($49,487).

- For the day, 306,627 traders were liquidated.

- The largest single liquidation order happened on Huobi-BTC value $21.25M.

- Over the past few days Bitcoin, with the highest dominance rate in the crypto market gained over 15% and hit an all-time high of $49,487 taking into consideration future demand for the popular crypto asset amid institutional buying.

The bearish trend gained momentum immediately after the flagship crypto touched $46,500 value amid several large sell orders placed above that price.

The Crypto market had suddenly become overheated and record sell-offs began leading traders to lose about $2 billion.

At the time of drafting this report, Bitcoin’s volatility ensured that no firm market direction was in control, as Bitcoin fluctuated around $46800. Sequel to the sudden correction seen in the Bitcoin market lately, it had been in on a bullish run relatively.

The price of Bitcoin is often volatile because of its high use for financial gain and speculating advantages used by global investors and crypto traders. As such, individuals and hedge funds sell and buy Bitcoins as they would do for any other financial asset (stocks, bonds) with regulatory limitations.