Nigeria is grappling with a substantial increase in the prices of essential medicines, raising concerns among the Nigerians. The surge is suspected to be linked with the devaluation of the currency and soaring inflation, prompting pharmaceutical companies like GSK to exit the Nigerian market.

Naira Devaluation and Inflation:

The persistently high inflation rate, recorded at 27.33% in October 2023, have contributed significantly to the escalating prices of various goods, including pharmaceuticals. Additionally, the alarming foreign exchange rate, with the Naira exchanging for N1130 per dollar in the parallel market, has made foreign pharmaceutical products less affordable. Major pharmaceutical players, such as GlaxoSmithKline (GSK), have decided to discontinue the direct commercialization of prescription medicines and vaccines in Nigeria. Operational challenges, including difficulties in maintaining a steady drug supply and scarcity of foreign exchange, have driven these companies away. External factors like regional insecurity, the removal of fuel subsidies, and the high cost of doing business in Nigeria have further influenced their decisions.

Impact on the Nigerian Pharmaceutical Market:

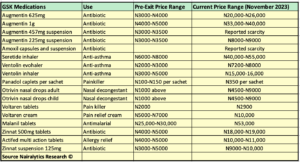

Comparison of some prices of drugs between 2022 and 2023

Following the recent economic situation, there has been a noticeable scarcity of its drugs across the country, affecting community pharmacies, particularly in Lagos. Traders report challenges in procuring various pharmaceutical products due to their decreased availability.

Pharmacies’ Perspective:

RateCaptain conducted interviews with community pharmacists to delve into the causes of the recent surge in drug prices, customer reactions, and their expectations from the government. All the pharmacists interviewed pleaded anonymity as they feared victimization by industry stakeholders some of whom do not encourage speaking to the media about prices.

One pharmacist stated, “Prices are soaring because of the major issue of the foreign exchange rate, then companies that left Nigeria, for instance, GSK, and they control most of the market products, something Nigerians are not really aware of. We also have companies planning to leave, so there will be more shortage of medicines leading to price increases.”

Another added, “The scarcity of these medicines creates an increase in demand which leads to an increase in prices of medicines. If these companies left the country and directly imported medicines, they wouldn’t be this expensive, but based on exchange rates and certain government policies on importation, that’s why they are expensive.”

Speaking with a Behavioral pharmacist, he emphasized, “Customers are now opting for cheaper brands, but there are some particular products that they just have to sacrifice for, like asthma medications. There are no options. Some have to cut down on feeding and supplements just to get medicines, especially how the rate of inflation is hitting sky high.”

Public Reactions:

Rate Captain also interviewed few members of the public to get their opinion of the crucial situation,

Mr. Yetunde Odetola commented, “100% devaluation of naira plus 27% inflation (127%) couldn’t have caused this nearly 600% price increase. Pharmacies are thieves. Period. Wetin demand and supply got to do with bare-faced thievery? Another policy failure. The government should have a price monitoring team to make sure people aren’t being price gouged.”

Dr. Bolaji Akinwale also added, “It’s obvious it’s not just about the fx rate. This is price gouging. Dollar has not yet experienced 100% depreciation since President Tinubu came in. Dollar was 900 in January before it went down to about 780 before inauguration and today it is 1140. I do not see 70% depreciation.”

Mr. Olabisi a Health Activist emphasized, “Capitalist free economy is fine, but it doesn’t mean you create Wild West-style economies with no guard rails. The US is your classic free-market system, yet we have consumer protection boards in the US to protect against price gouging. An antitrust agency prevents monopolies from emerging. There is a healthcare price negotiation agency to control drug prices for the government’s Medicare program. Why do our governments think free market equals ‘no thinking,’ free-for-all economies?”

Call for Government Intervention

The surge in drug prices has severe implications, particularly in the healthcare sector. The prevalence of antibiotic use in Nigerian hospitals and the increased medical expenses for common bacterial infections are concerning. Asthma patients, heavily reliant on these medications, face heightened costs amid economic challenges and medication scarcity.

Pharmacists unanimously called for government intervention to address the foreign exchange rate, enticing pharmaceutical companies back to Nigeria, and supporting local pharmaceutical manufacturing. They emphasized the need for accessible healthcare in government hospitals to ensure affordable drugs for Nigerians. Urgent government intervention is sought to alleviate the impact on healthcare and ensure the well-being of the population.