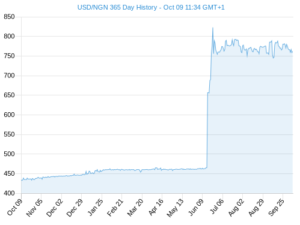

The Nigerian naira extended its slump in black-market trading at low as 1000/$ as the nation’s dollar shortage deepened two months after the central bank moved to a more flexible exchange rate to encourage inflows.

The currency of Africa’s biggest crude oil producer weakened to 1000naira per dollar, compared with 992 naira the day before, according to Akin Omodele, a bureau de change operator who tracks currency data in the nation’s commercial capital.

There are two major reasons why the exchange rate is rising rapidly, especially since June 14. The first reason, which is also the root cause of the naira depreciation, is that supply of dollars into the economy has been declining while demand for dollars remains relatively unchanged courtesy of the country’s huge demand for dollars fuelled by dependence on imported goods for many economic activities. This is reflected in persistent fall in the nation’s external reserves, which represents the amount of dollars and foreign currency available to the country for importation and transactions with other countries.

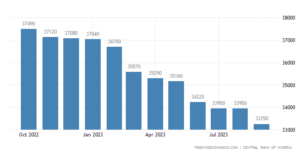

Data from the CBN shows that the nation’s external reserves fell by $3.23 billion or 8.5 per cent to $33.92 billion on July 9 from $37.15 billion on December 31st 2022.

The Second reason is the persistent decline in Net Foreign Inflow(NFI). The reduction in the net foreign inflow is the fall in foreign investment inflow into the economy. According to the National Bureau of Statistics, NBS, Capital Importation (Foreign Investment) into Nigeria fell from $23.99 billion in 2019 to $5.33 billion in 2022. This represents a huge 77.8 per cent decline in a major dollar supply source into the country. The fact that the external reserves fell by $3.23 billion or 8.5 per cent this year indicates that the above trend in Net Forex Inflow and foreign investment inflow, has not changed.

That is confirmed by the sharp decline in the volume of dollars traded (turnover) in the official forex market, represented by the Investors and Exporters, I&E window.

In the first six months of this year, H1’23, turnover in the I&E window fell to $13.11 billion. This represents a 35 per cent fall when compared with turnover of $20.23 billion recorded in the first half of 2022, H1’22. The above trend explains the acute dollar scarcity in the economy.

And like other commodities when demand is higher than the supply, the price will rise, all things being equal. Hence the continuous rise in the exchange rate, which is the price of exchanging Naira for dollars

Nigeria Naira vs. Nigeria interest rate differentials

In its pursuit of taming inflation, the CBN has adopted an aggressive stance, hiking interest rates to levels previously unseen. While the intention behind these measures is clear – to curb inflationary pressures – the outcomes have been less favorable than anticipated. The elevated interest rates have made it increasingly challenging for industries to secure business loans. This impediment to borrowing has hindered efforts to boost productivity and expand operations. The business landscape’s financial constraints extend to the export sector. Elevated interest rates make it less feasible for businesses to engage in international trade, which, in turn, constrains the nation’s ability to build its external reserves. The steady ascent of interest rates has sent shockwaves throughout the economy, with one of the most significant tremors being the decline in foreign investment inflow. The inherent instability of the Naira and the broader economic environment have prompted many foreign investors to reconsider their commitments to the country.

FOREIGN DIRECT INVESTMENT IN NIGERIA KEEPS DECLINING

Nigeria’s external reserve has fallen by about $2.8 billion in the first half of 2023 as Nigeria continues to struggle with weak crude oil output and a lack of foreign investor participation in the capital market.

The external reserves opened the year at about $37 billion but have now dropped to about $34.1 billion as of June 2023. Nigeria’s external reserve is an important barometer for valuing the country’s currency. It is also used to estimate how many months of imports it can finance.

The external reserve has also dropped by almost one billion dollars since the Tinubu administration came into power on May 29th, 2023. The external reserve has gone from $35 billion as of May 30th to $34.1 billion. This is despite the unification of the naira and the introduction of a managed exchange rate float.

A cursory review of the data shows this is the largest half-year drop since 2015 when the external reserves went from $34.4 billion at the end of the year to $28.1 billion by the end of the first 6 months of June 2015.

The country’s external reserves have been on a downward trajectory since this year due to a lack of foreign investor inflows, lower crude oil outputs, and a fragmented forex market.

The Future Outlook

The future of the Naira depends on several critical factors:

Oil Prices: As a major oil exporter, Nigeria’s economy remains closely linked to global oil prices. Any significant changes in oil prices will impact the Naira’s stability.

Economic Diversification: Nigeria’s efforts to diversify its economy away from oil are crucial. Economic diversification can reduce the Naira’s vulnerability to oil price fluctuations.

Inflation Control: Maintaining control over inflation is essential to protect the Naira’s value and purchasing power.

Foreign Exchange Reserves: Adequate foreign exchange reserves are necessary to support the Naira and ensure liquidity in the market.

Investor Confidence: Rebuilding investor confidence through stable policies, improved security, and a favorable business environment can attract foreign investments and strengthen the Naira.

This pattern is expected to persist for an extended period, potentially exceeding six months, marked by significant fluctuations in the I&E window exchange rate. The key to resolving this situation lies in achieving a surplus of forex supply over the substantial demand for foreign exchange, leading to an increase in Net Forex Inflow and bolstering external reserves.

The current scenario mirrors the circumstances witnessed between 2016 and 2017, which prompted the establishment of the I&E window and other measures aimed at boosting forex inflow, particularly from foreign investors. These measures ultimately resulted in the appreciation of the Naira and the eventual alignment of the official and parallel market exchange rates.

In February 2017, prior to the implementation of these CBN measures, the parallel market exchange rate stood at N520 per dollar. Subsequently, it steadily declined, eventually converging with the I&E window rate at N360 per dollar in 2019.

There is optimism that a similar trajectory will unfold over the next 12 to 18 months.