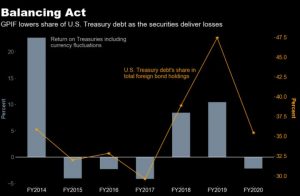

Japan’s Government Pension Investment Fund made a record cut to the weighting of Treasuries in its portfolio last fiscal year as the world’s safest asset led a global debt selloff.

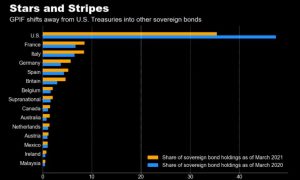

GPIF, as the world’s biggest pension fund is known, lowered U.S. government bonds and bills to 35% of its foreign debt holdings in the 12 months ended March, from 47% previously, according to an analysis by Bloomberg of the latest data. The weighting pivot comes largely from the Japanese fund increasing investments into European sovereign debt.

The rebalancing comes with the fund now over a year into a new investment plan that’s reduced dependence on Japanese government bonds and shifted focus toward higher returning equities and overseas debt. While GPIF offers little commentary on annual changes in its portfolios, even small adjustments reverberate through world markets given its total investments of about $1.7 trillion.

GPIF said in its annual report that it adjusted allocations to reduce deviations from benchmarks. Some strategists suggested the pension giant may have sought to trim Treasuries because of an extended period of underperformance. Others said this could have been incidental as it moved to reduce risk by aligning weightings with global indexes.

To be sure, GPIF’s Treasury holdings had shot up in the year earlier, particularly in shorter maturities, just as it was mulling the new investment plan. This offers yet another reason — that extra funds had only been parked temporarily in U.S. bills and notes as a substitute for cash before the fund settled on more permanent allocations.

Whatever the motives may have been, GPIF made a 7.1% return on overseas debt last fiscal year, versus 5.4% for FTSE Russell’s World Government Bond Index excluding Japan, which it measures performance against. That represents the strongest result in four years versus the benchmark.

FTSE Russell’s weighting for Treasuries was around 38% as of the end of June, including Japanese debt.

GPIF’s allocations for French, Italian, German and the U.K. bonds all increased by at least 1.7 percentage points in the 12 months through March. Purchases of these securities totaled 5.72 trillion yen ($52 billion) after adjusting for fluctuations in exchange rates and bond prices, Bloomberg’s analysis found.

While the weighting for U.S. bonds fell, GPIF still added about 1.1 trillion yen worth of Treasuries to its holdings last fiscal year, after adjusting for currency fluctuations and bond returns, according to Bloomberg’s analysis. That took its hoard to about 17.5 trillion yen.

Under its five-year investment plan that took effect in April 2020, GPIF aims to split its portfolio evenly between stocks and bonds, with these two asset classes then divided equally between domestic and foreign markets. Japanese government bonds previously had a 35% weighting in total investments.