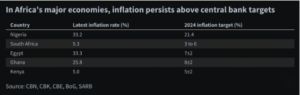

In April 2024, African markets experienced distinct economic trends, marked by varying inflation rates across different countries. While Nigeria and Ghana saw an uptick in inflation, South Africa, Egypt, and Kenya witnessed declines.

In Nigeria, inflation remained high, standing at 33.2% in March 2024. Persistent bearish inflation expectations, the pass-through effect of exchange rate fluctuations on commodity prices, and ongoing food price pressures contributed to this elevated rate. Projections suggest that inflation in Nigeria may continue to rise in the coming months. In contrast, Kenya and Egypt experienced a moderation in annual inflation figures. Kenya reported a decrease to 5% in April 2024, significantly below conservative projections. This decline indicates reduced inflation risks in Kenya, primarily due to easing currency pressures. Similarly, Egypt’s inflation rate cooled to 33.3% in March, down from a four-month high of 35.7%, as food and energy costs decreased.

Monthly inflation data provides further insights, reflecting current price pressures. Nigeria’s month-on-month inflation eased to 3.02% in March, attributed to a 24% gain in the value of the naira. This appreciation alleviated pressure on food and energy costs, leading to lower prices. Egypt also witnessed a sharp deceleration in monthly inflation to 0.95%, with significant declines in food and non-food prices. Ghana experienced a similar slowdown, with monthly inflation decreasing to 0.8% in April, down from 1.6% in February, driven by easing food and energy costs.

These downward trends in monthly inflation rates underscore a reduction in price pressures across key African countries, signaling a shift towards a more favorable economic environment. However, it’s noteworthy that most countries still have annual inflation rates above central bank targets.

Overall, the contrasting inflationary trends in African markets reflect the complex interplay of various economic factors. While some countries grapple with persistently high inflation, others are witnessing a gradual moderation, offering hope for improved economic stability and growth in the region.