One year after Aboki FX was accused of “economic sabotage” and his acts were effectively criminalized by the Central Bank of Nigeria (CBN), the Naira lost 25% of its value.

Everyone in Nigeria could estimate the cost of black market rates using AbokiFX as a benchmark. As a result, the apex bank found it simple to accuse them of currency manipulation.

The Naira was trading at about N570/$ on September 17, 2021, when aboki Fx stopped publishing forex rates. A year later, the Naira had fallen to about N710/$. This is a reduction of 25% in just one year.

What happened

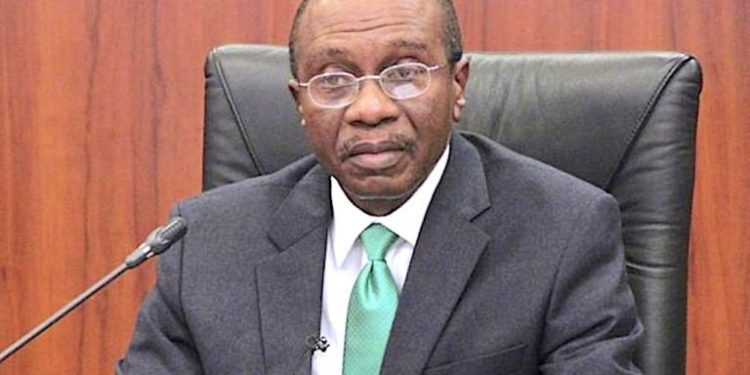

This all changed when the Central Bank Governor, Godwin Emefiele, startled Nigerians at his monetary policy briefing on September 17th, 2021, by accusing abokiFX of foreign currency manipulation, implying that it benefitted by setting black market rates that purposefully boosted the price.

The CBN Governor “It is economic sabotage and we will pursue him, wherever he is, we will report him to international security agencies, we will track him, Mr Oniwinde, we will find you, because we cannot allow you to continue to conduct an illegal activity that kills our economy.” Emefiele said.

Consequently, the website’s owner, Mr Olumide Oniwinde, issued a press release categorically refuting the claims and suspended the platform’s display of FX rates pending the settlement of the case.

He said, “AbokiFX has taken the decision today, the 17th of September 2021, to temporarily suspend rate updates on all our platforms until we get better clarity of the situation.”

What you should know

The Central Bank’s crackdown on the proprietor of abokiFX was intended to protect the naira from a continuing wild collapse blamed on speculation.

Therefore, It is worth noting that the black market saw temporary stability for about 3 weeks after AbokiFX stopped providing forex rates. Nonetheless, the success was fleeting, as the Naira is currently witnessing a double-digit decline one year later.

In a recent tweet aboki, Fx sent a friendly reminder to the public suggesting they had no role to play in the free fall of the Naira despite the many accusations.

Aboki FX said, “This time last year, we suspended rate publication to test the impact on the parallel market exchange rate. A further 25% decline has been recorded.” He added.