China’s ongoing efforts to address economic challenges have led to its central bank making a strategic move – the reduction of the main benchmark interest rate used by commercial banks in issuing one-year loans. While this action aims to support credit growth and boost economic activity, its modest nature and the government’s utilization of conventional tools have sparked discussions about their effectiveness. This blog delves into the recent interest rate cut by China’s central bank, its implications for the economy, and the evolving dynamics of China’s financial landscape.

Interest Rate Cut and its Implications:

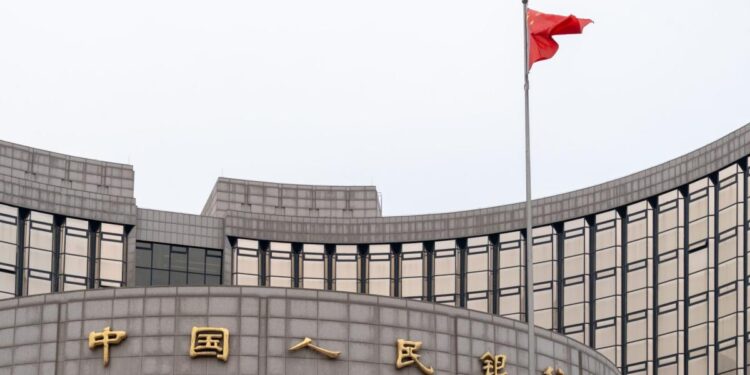

On Monday, China’s central bank, the People’s Bank of China, announced a slight reduction of the one-year interest rate for commercial bank loans by a tenth of a percentage point, bringing it to 3.45 percent. This move, the second such cut in two months, is intended to stimulate borrowing by making it marginally cheaper for companies and households to access credit and manage existing loans.

The central bank’s strategy of easing borrowing costs is designed to counteract various economic challenges, including falling apartment prices, weak consumer spending, and broader debt concerns. However, the size of the cut, smaller than anticipated, highlights the limitations of conventional monetary tools in the face of complex economic circumstances.

Effects on Real Estate Sector and Banking Margins:

China’s commercial banks have been significantly exposed to real estate lending, which has posed risks due to the country’s housing market instability. By maintaining the benchmark interest rate for five-year loans used in setting mortgage rates at 4.2 percent, the central bank aimed to preserve the profit margins for banks. This strategy is particularly relevant given that more than 50 real estate developers have defaulted on overseas bonds and the recent financial difficulties faced by the country’s largest developer, Country Garden.

The more measured interest rate cut serves as a means to bolster banks’ reserves, potentially helping them offset real estate-related losses. This decision aligns with the government’s efforts to maintain the stability of the banking sector while supporting targeted sectors of the economy.

Bottom Line:

China’s central bank’s recent interest rate cut reflects a delicate balancing act between addressing economic challenges and ensuring the stability of the financial sector. While the modest nature of the cut may not provide significant stimulus, it underscores the evolving landscape of China’s economic policy. As economic challenges continue to evolve, policymakers will likely explore a combination of measures to navigate the complexities of the financial environment and achieve sustainable economic growth.