The Central Bank of Nigeria announced on Friday that it was offering a Nara4Dollar initiative that will reward anyone who remits dollars via banks N5 for every $1 remitted.

However, data from the website of the central bank may provide further insight into why the central bank is embarking on such an unprecedented scheme which according to our analysis could add an extra premium on the prevailing black market rate.

The CBN reports Diaspora remittances in two of its research reports, Balance of Payment and Foreign Currency Flows. The BoP collates remittances the included cash and goods and services brought into the country by Nigerians in Diaspora.

The remittances included in the Foreign Currency flows are mostly if not all cash only and is perhaps the best proxy of just how much diaspora remittances in cash, the central bank has received through the official banking system.

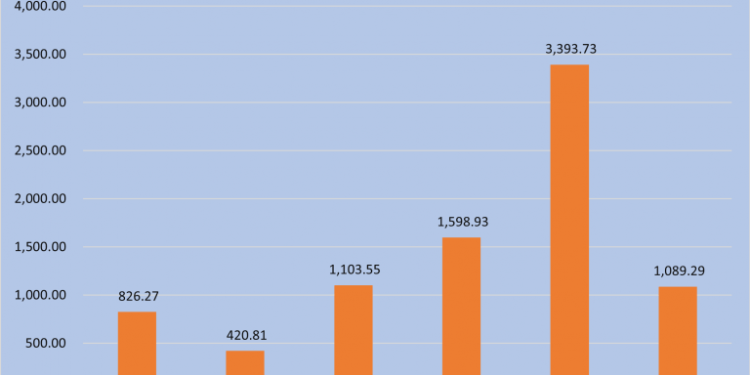

In 2019, Nigerians abroad remitted a record $3.3 billion via official channels, the highest in the last 5 years. However, in 2020 where the exchange rate was devalued and the disparity with the black market rates widened remittances plummeted by as much of 61% from $2.8 billion Q3 YTD in 2019 to $1.09 billion same period in 2020.

This huge drop can be attributed to the effects of Covid-19 in the US, Canada, and the UK, where a lot of Nigerians live, and the disparity between the parallel market and the official exchange rates.

The Central Bank claimed: “This new measure will help to make the process of sending remittances through formal bank channels cheaper and more convenient for Nigerians in the diaspora” hoping this will help boost liquidity in the retail end of the forex market.

The Central Bank in a series of tweets on Saturday cited a PwC report stating as follows. “PwC forecasts suggest that Nigeria’s remittance flows could reach US$34.89 billion by 2023. But this can only be accomplished if remittance infrastructure improves and if the right policies are put in place.