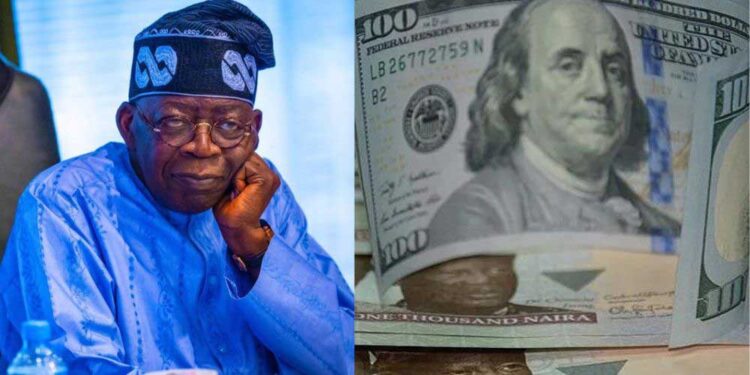

In a recent interview with Bloomberg News, Taiwo Oyedele, the Chair of the Presidential Committee on Fiscal Policy and Tax Reforms, revealed that the federal government is determined to bring down the dollar exchange rate at the Investors and Exporters (I&E) Window to N750 per dollar by December. This ambitious plan is set to address the significant gap between the official exchange rate and the black-market rate, currently standing at a staggering 45 percent.

Oyedele outlined several measures to achieve this goal, which includes the implementation of new foreign exchange regulations and a crackdown on illegal currency trading activities. Additionally, the government plans to address the backlog of dollar demand, which is estimated at approximately $6.7 billion. Furthermore, it aims to strengthen the naira forward market and establish transparent guidelines for the operations of the official foreign exchange market.

One of the key strategies in the government’s plan is to expand the official market to accommodate all legitimate transactions while eliminating the illicit “black market” for foreign currency. Oyedele emphasized, “We think all of that will happen before December, and maybe in a matter of a couple of weeks, we will begin to see the results, such that before the end of the calendar year, the naira should find its true value, not the one that is being done currently in the parallel market.”

The Committee Chair stated that a “fair price” for the dollar is between 650 to 750 naira, which translates to N802.59 to the dollar. This is in stark contrast to the current black-market rate, which stands at N1,165 to the dollar. The proposed measures aim to narrow this gap and restore stability to the foreign exchange market.

The government’s commitment to achieving this goal reflects its determination to address the economic challenges posed by the significant divergence between the official and black-market exchange rates. As December approaches, stakeholders will be closely watching to see if these proposed measures can successfully bring the dollar rate down to N750 and help stabilize the Nigerian economy.