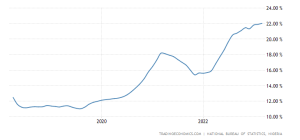

For the past 5 years, Nigeria’s inflation rate has been on an upward trend, which has been triggered by a global pandemic, supply-chain disruptions, and the war in Ukraine, contributing to a rapid rise in the cost of fuel, food, and a broad range of goods. Nigeria has been experiencing a double-digit inflation rate since the 1980s.

Inflation rates are most often measured by the consumer price index, or CPI, which is calculated based on a total “basket” of goods and services bought by all consumers in a national economy. However, these inflation rates may not necessarily represent the impact that inflation has on you personally.

For example, the latest Nigerian national basket assumes that 10.8 percent of household budgets are spent on personal transport, such as owning and using a car. While this may be representative of Nigeria as a whole, it may not be at all representative of you as an individual if, for example, you do not own a car or use it significantly less than the national average.

Why estimate your personal inflation rate?

Knowing your personal inflation rate is crucial because it allows you to estimate your experience of inflation according to the constraints, priorities, and preferences that shape your personal spending patterns. It is a way of gaining insight into how inflation affects your personal finances.

Estimating your personal inflation rate is a straightforward process. Begin by tracking your spending over a set period, such as a month, and comparing it to your spending from a similar period in the past. You can then calculate your personal inflation rate by comparing the differences in the cost of the goods and services you buy.

Understanding your personal inflation rate is a powerful tool for creating a budget that reflects your unique spending patterns. By knowing how inflation affects you personally, you can adjust your spending habits to stay ahead of rising prices and make informed financial decisions.

In conclusion, estimating your personal inflation rate is an essential step towards taking control of your finances. It is a way of gaining insight into how inflation affects you personally and allowing you to adjust your spending habits accordingly. With the right tools and knowledge, you can stay ahead of rising prices and make informed financial decisions.