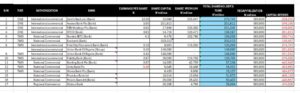

The Central Bank of Nigeria (CBN) has unleashed a wave of stringent capital requirements, shaking up the country’s banking sector. This comprehensive report delves into the granular details of the capital needs for each listed bank to align with the CBN’s robust standards.

Rigorous data gathering from official sources, encompassing regulatory filings and CBN pronouncements, forms the backbone of this investigation. The capital deficit for each bank was meticulously calculated, subtracting their existing capital from the mandated recapitalization amount stipulated by the CBN.

Source: RateCaptain

Detailed Breakdown:

Tier One Titans:

- Zenith Bank Plc: A staggering N270.745 billion shortfall looms to meet the stringent CBN criteria.

- Access Bank Plc: The demand stands at N251.811 billion to bridge the gap and comply with regulatory standards.

- FBN Holdings Plc: Eyes are on N251.340 billion to fulfill the requisite capitalization threshold.

- GTCO: Navigating a capital chasm, requiring N138.187 billion for compliance.

Tier Two Titans:

- Stanbic IBTC: Must muster N109.259 billion to synchronize with the new capital benchmarks.

- Ecobank: Grappling with a hefty requirement of N353.513 billion to satiate the regulatory appetite.

- First City Monument Bank (FCMB): Confronts a N125.293 billion gap in meeting regulatory prerequisites.

- Union Bank of Nigeria: A monumental task looms, necessitating N351.910 billion for regulatory alignment.

- Fidelity Bank: A formidable challenge beckons, demanding N129.705 billion to toe the regulatory line.

- Sterling Bank Plc: Strives to bridge a N57.154 billion chasm to adhere to regulatory dictates.

- Unity Bank Plc: Must navigate a N16.331 billion hurdle to secure regulatory compliance.

- Wema Bank Plc: Faces a N15.127 billion gap in aligning with the stringent regulatory framework.

Other Contenders:

- Providus Bank Ltd: Wrestling with a N31.872 billion capital chasm to meet the stipulated threshold.

- Polaris Bank Ltd: Under the spotlight with a N50.433 billion requirement to fulfill regulatory obligations.

Bottom Line

The CBN’s unwavering stance on bolstering Nigeria’s banking sector through stringent capital requirements underscores a pivotal juncture in the nation’s financial landscape. With the onus squarely on listed banks to fortify their capital reserves, strategic maneuvers and robust financial planning are imperative to navigate these tumultuous waters and ensure regulatory compliance. As the banking fraternity braces for this seismic shift, the imperative of fortifying capital reserves looms large on the horizon, shaping the trajectory of Nigeria’s financial future.