In the face of unprecedented challenges posed by the rapid depreciation of the Nigerian naira, the Central Bank of Nigeria (CBN) has emerged as a beacon of hope, implementing a series of bold and decisive measures to safeguard the nation’s currency. Over the past twelve months, as the naira witnessed alarming devaluation, the CBN orchestrated a multifaceted approach to address the exchange rate crisis head-on. From unifying exchange rates to clearing legacy backlogs and removing forex restrictions, the CBN’s interventions have played a pivotal role in stabilizing the currency and restoring confidence in Nigeria’s economic prospects.

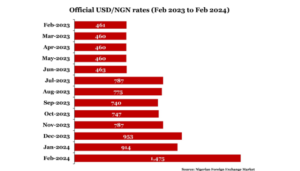

In February 2023, obtaining a dollar in the official market cost N460. Fast forward to February 2024, and the price skyrocketed to N1,475 per dollar in the same market. This staggering 21.8% loss in value within just twelve months has sparked significant disruptions in Nigeria’s economic landscape. Businesses are grappling with soaring costs, particularly for imported inputs, while households are feeling the pinch as prices of essential goods surge.

Source: Trading Economics

CBN’s Policies and Interventions

Amidst the naira’s downward spiral, the Central Bank of Nigeria (CBN) has been proactive in implementing various policies to address the exchange rate crisis. Let’s delve into the rationale behind some of these key interventions:

1. Unification of Exchange Rates

In June 2023, the CBN made a pivotal move by unifying all exchange rate windows, transitioning to a single Importers and Exporters (I&E) window operating on a “willing buyer, willing seller” basis. This marked a departure from the previous multiple-exchange window system and aimed to introduce market forces into determining the dollar’s price. However, this shift saw the official market rate surge from N460 to N620 per dollar, reflecting the influence of supply and demand dynamics.

2. Liquidity Challenges and Parallel Market Dynamics

While the unification of exchange rates was a step in the right direction, liquidity remained a pressing issue. Surging demand for foreign exchange, coupled with limited supply, fueled the growth of the parallel market where the dollar’s price soared to N740 by September 2023. This divergence underscored the ongoing challenges despite regulatory efforts.

3. Removal of Forex Restrictions on Import Items

In a bid to address liquidity constraints and reduce parallel market pressures, the CBN reversed its stance on restricting 43 import items from accessing official forex channels. The initial restrictions had inadvertently fueled demand in the parallel market, exacerbating exchange rate volatility. By lifting these restrictions in October 2023, the CBN aimed to restore orderliness and stability to the forex market.

4. Directives on Bank Forex Holdings and IMTO Guidelines

Further measures included directives for banks to sell off excess forex holdings and revised guidelines for International Money Transfer Operators (IMTOs). These actions aimed to enhance liquidity, streamline foreign inflows, and bolster transparency in forex transactions, albeit within a regulated framework.

5. Removal of Spread Limit on FX Transactions

Most recently, the CBN announced the removal of limits on the spread (profit margin) banks could charge on foreign exchange transactions. This move aimed to incentivize banks to participate more actively in forex trading, promoting the “willing buyer, willing seller” model and fostering market liquidity.

6. CBN Clears ‘Valid’ FX Transactions To Eliminate Legacy Backlog

In a recent development, the CBN has announced the clearance of all valid foreign exchange backlogs amounting to $7 billion, fulfilling a key pledge by Governor Olayemi Cardoso. Independent auditors meticulously assessed these transactions to ensure legitimacy, with $1.5 billion settled to bank customers, effectively eliminating the residual balance of the FX backlog. This milestone signifies a crucial step towards restoring credibility and confidence in the Nigerian economy

The Road Ahead

While the CBN’s policies represent crucial steps in addressing Nigeria’s exchange rate challenges, they cannot single-handedly resolve the country’s economic woes. Structural reforms, including measures to attract foreign investment, combat crude oil theft, enhance public accountability, and tackle insecurity, are imperative for sustained economic growth. while the CBN’s interventions are commendable, concerted efforts from both monetary and fiscal authorities are essential to steer Nigeria towards economic stability and prosperity amidst prevailing challenges.