Foreign direct investment (FDI) is an investment from a party in one country into a business or corporation in another country with the intention of establishing a lasting interest. Lasting interest differentiates FDI from foreign portfolio investments, where investors passively hold securities from a foreign country. A foreign direct investment can be made by obtaining a lasting interest or by expanding one’s business into a foreign country.

Foreign investment in Nigeria has been on a persistent fall since 2011 , From 2011 to 2013 nigeria was the top destination for FDI.

Experts have said this steady inflow of FDI into Nigeria will accelerate the country’s quest to rank among the top 20 economies in the world by the year 2020.For instance, they point out substantial improvement in power supply, as is currently being recorded, will help Nigeria move rapidly to the next level of development. It is expected that the various power projects which GE intends to execute in partnership with local firms, will further boost output. This will have multiplier effect on virtually all sectors of the economy, as it will lead to lower production costs and more profitability for companies.

Fast-forward to 2021 and the FDI value is 2.6 billion Naira a minimal increment from 2020 value of 2.3 billion naira

WHY HAS NIGERA’S FOREIGN DIRECT INVESTMENT BEEN ON AN AVERAGE DECLINE ?

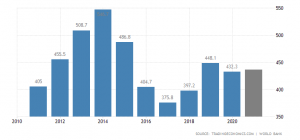

- GDP: The Gross Domestic Product (GDP) in Nigeria was worth 432.30 billion US dollars in 2020 compared to 2019 which was $448 billion dollars.A country withfluctuating GDP discourages FDI and creates uncertenties in the investment market.

A country with fluctuating GDP discourages FDI and creates uncertainties in the investment market.

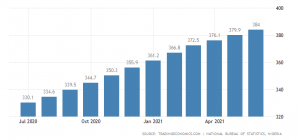

- Inflation: The inflation rate (consumer price index) of a country—used as a proxy for macro-economic stability. Inflation rate in Nigeria has been on a consistently high rate since 2019 to 2021 the current rate stands at approximately 17%. From the chart below inflation has been an a draconian rise since july 2020

- Trade: Representing openness to trade i.e., the ratio of total trade (exports + imports) to GDP—used as a policy variable. The recent investment on infrastructure can be seen as a bright light, because this can facilitate trade. The recently completed border project between Nigeria and Cameroon serves a conduit for boosting trade and increase FDI.

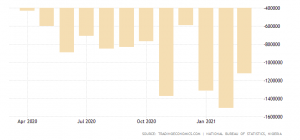

- Nigeria’s trade deficit widened to NGN 1123.3 billion in March of 2021 from NGN 554.5 billion in the same month a year ago. Imports surged 44.4% to NGN 2194 billion while exports rose at a softer 11% to NGN 1070 billion. Considering the first quarter of 2021, the country’s trade gap widened to a record high of NGN 3944 billion from NGN 330 billion in the same period a year ago, as imports surged 54% to NGN 6851 billion, its highest level in over 12 years, due to higher purchases of energy goods (1347%), agricultural goods (141%) and raw materials (109%). Conversely, exports fell 29.3% to NGN 2907 billion, as shipments fell primarily for manufactured products (-43.7%) and crude oil (-34.5%). China, India, the Netherlands, Spain and the US were the main trading partners in Q1