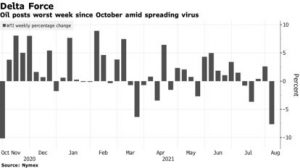

Oil plunged to a three-week low, extending losses after the worst week since October, as the resurgence of Covid-19 threatened the outlook for fuel demand.

Futures fell below $66 a barrel in New York after sliding almost 8% last week. The flare-up has led Goldman Sachs Group Inc. to downgrade its economic growth forecast for China, which recently completed a mass testing program in Wuhan — the original epicenter of the pandemic — following new confirmed cases. Infections have also climbed in the U.S. and Thailand.

“Oil is seeing a continued loss of momentum, with sentiment taking a knock,” said Ole Hansen, head of commodities research at Saxo Bank A/S. “Most importantly, worries about the short-term demand outlook as governments respond to a surging delta variant” are weighing on the market.

Crude has run into stiff headwinds this month as the fast-spreading delta variant sweeps across the globe, leading to renewed restrictions, and as expectations that the Federal Reserve will ease stimulus strengthens the dollar.

Delta is also impacting the oil market structure. The prompt timespread for Brent has narrowed to 35 cents a barrel in backwardation — a bullish signal where near-dated contracts are more expensive than later-dated ones. That compares with 69 cents a week earlier.

Still, further price losses may be contained as the OPEC+ alliance led by Saudi Arabia continues to stabilize supply levels, avoiding a new surplus. The group is gradually restoring production it halted when the coronavirus first emerged last year.

“Despite the Delta spread, the market is undersupplied on our estimates, so we believe further downside risk is limited in the short term,” said Helge Andre Martinsen, senior oil market analyst at DNB Bank ASA.