Walmart Worries

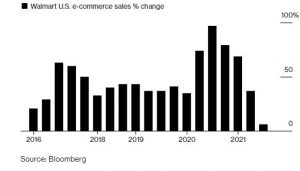

Is the Covid-era shopping boom fading? On Tuesday Walmart Inc. reported U.S. online sales rose 6%, far slower than earlier in the pandemic when the company routinely posted high double-digit gains.

Walmart, along with other retail giants such as Target Corp., Home Depot Inc., and Amazon.com Inc. posted record-breaking growth for much of 2020 as lockdowns caused consumers to spend more money online. As some economies open up, analysts are questioning whether companies can hold on to last year’s gains.

These worries took the shine off a strong quarter for Walmart, whose sales beat analysts’ expectations. Shares were merely up about 1% this week despite the company raising its full-year sales forecast, in part because of optimism over the crucial back-to-school shopping season.

What’s next? “There is probably some caution” from Walmart investors, who had elevated expectations coming into this earnings report, Edward Jones analyst Brian Yarbrough said. It’s also not clear how retail sales performance will turn out once government stimulus wanes, he said.

Slowing Down

Online sales growth at supermarket giant Walmart is stalling

Booster Shot

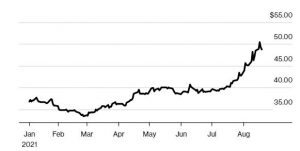

It has been a turbulent week for Covid vaccine makers. President Joe Biden’s announcement that the U.S. plans to offer booster shots as soon as next month gave the shares a boost of their own. But a U.K. study suggesting BioNTech SE and Pfizer Inc. vaccines lost effectiveness in the three months following vaccination knocked the stocks.

After both jumps and declines, Pfizer closed Thursday up just 0.7% on the week. Moderna Inc. was down 4%.

Both Moderna and BioNTech have amassed triple-digit gains this year. Pfizer has only managed a relatively small 33% rise despite being the first domestic company to win authorization for a shot in the U.S. Still, the company is getting more interest from the day-trading crowd, with retail investors snapping up about $63 million of the shares on Tuesday alone, according to data from Vanda Research. Such investors sold off more positions than they bought in Moderna and BioNTech.

What’s next? In the short term, the outlook is all about what happens with Covid. “Higher prices and multiple boosters could drive expectations higher; safety concerns, production and logistical issues and limited booster use would have an opposite effect,” Bloomberg Intelligence analyst John Murphy said.

Shot in the Arm

Pfizer shares hit a record high after Biden’s booster shot announcement

Source: Bloomberg data

China’s Tech Woes

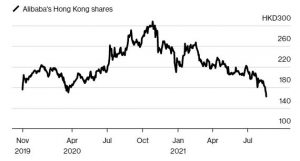

Investors have well and truly fallen out of love with China’s big tech giants. Alibaba Group Holding Ltd. slumped to a record low in Hong Kong on Thursday. Video streaming giant Kuaishou Technology slid 7.1% to close at a new all-time low for a fifth consecutive session.

The renewed selling came after China said it was studying proposals to boost rights for drivers in the gig economy and step up oversight of the live-streaming industry.

While the moves are incremental, they add to the turmoil around the country’s tech industry, currently caught in the midst of a sweeping government crackdown. About $1 trillion was wiped off the market value of Chinese shares listed globally this summer and some fund managers such as Cathie Wood have dumped their holdings in Chinese stocks.

What’s next? Investors are cautious. “Even if the worst is over for big tech firms in terms of new regulations, we should expect that their growth won’t be what it was,” said Shine Gao, fund manager at Taicheng Capital Management Co.

Heading Down

Internet giant Alibaba hit a record low as concerns about regulation mount

Source: Bloomberg

BHP Shakeup

It was an eventful week in the mining industry.

The world’s largest mining company, BHP Group, announced plans to move back to a primary listing in Australia — which means it will leave the U.K.’s FTSE 100. The company is also selling its oil and gas operations and spending $5.7 billion on a massive fertilizer mine in Canada.

Meanwhile, iron ore, which was already down substantially from May’s record highs, closed down 12% on Thursday in Singapore. That was the lowest since December.

There are multiple factors weighing on the steelmaking material. Many come from China. The country is pushing forward with a pledge to curb steel production, partly driven by a desire to reduce pollution to ensure blue skies ahead of the Beijing 2022 Winter Olympics. Demand is also expected to wane as the country moves to rein in the property market.

What’s next? “Iron ore remains the most China-centric of all commodities,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S. “So when economic activity slows, the virus spreads and supply lines are being disrupted, iron ore will be in the firing line.”

LPG Surge

Already lofty liquefied petroleum gas prices are heading even higher. Benchmark propane prices in Asia have jumped almost 40% since the end of April. European prices are 70% higher than seasonal norms.

One key factor is surging demand from China, where new propane dehydrogenation plants — which turn the fuel into petrochemicals that make everything from surgical masks to car interiors — are coming on stream.

Analysts are braced for the record-breaking run to continue. That is in part because of a lingering supply shortage. At the same time, the onset of winter in the northern hemisphere tends to result in a spike in demand because the fuel is used for heating homes.

What’s next? “If temperatures drop like last winter, then prices could really test new limits,” said Sam Sng, a senior analyst at industry consultant FGE.