Nigeria’s inflation has been on the rise, reaching a 17-years high of 19.64 percent in July 2022, and having severe implications for businesses and households.

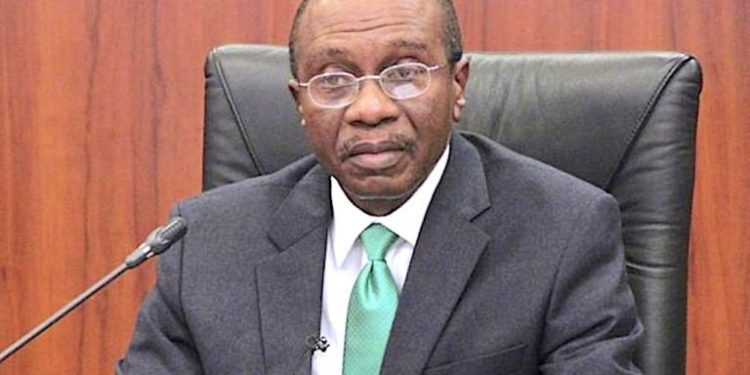

With the inflation pressure in the country intensifying month-on-month in 2022 (NBS data shows that inflation has increased steadily year-to-date), the Central Bank of Nigeria (CBN) pivoted toward a tightened monetary policy.

Although the CBN’s interest rate hikes have been in sync with the resolve of many other Central Banks that have raised benchmark rates in curtailing inflation, an important question to raise is, whether monetary policy tools (interest rate hikes) are still effective for taming Nigeria’s inflation.

Higher interest rates mean higher borrowing costs. In theory, it clamps down on investment activities, slows down the economy, reduces spending, and ultimately deflates price levels.

But the reality playing out in Nigeria does not align with this economic theory. In May 2022, Nigeria’s Central Bank raised interest rates after inflation trajected upward from the beginning of the year. The action was expected to contain the rising inflation in the country, however, inflation maintained its pace. The apex bank still pushed up the benchmark rate in July as it aimed at stabilizing price levels, unfortunately, inflation rose again and still tends to move upward.

Nigeria’s inflation has become unsusceptible to CBN’s interest rate hikes as it continues rising unabatedly. In our opinion, the monetary rate has reached a saturation point in effectively taming Nigeria’s inflation.

Nigeria’s inflation has become unsusceptible to CBN’s interest rate hikes as it continues rising unabatedly. In our opinion, the monetary rate has reached a saturation point in effectively taming Nigeria’s inflation.

Taking a Closer Look at Nigeria’s Inflation Indices

According to the July Consumer Price Index (CPI) data released by the National Bureau of Statistics (NBS), core inflation, which stood at 16.26%, rose on the wings of rising prices of gas, liquid and solid fuel, passenger transport by road, passenger transport by Air, Garments, Cleaning, Repair and Hire of clothing.

Food inflation was caused by the increasing prices for bread and cereal, food products n.e.c, Potatoes, yam and other tubers, meat, fish, oil, and fat. However, on a month-on-month basis, food inflation had a decline of 0.01 percent as a result of the reduction in the prices of tubers (yam, potatoes, and other tubers), vegetables, maize and garri. What this means is that the prices of bread and cereal were still souring high when the prices of other food items are coming down.

Also, urban inflation is 20.09% while the rural index is 19.22%. We can see here that the difference between the two indices is fuel, which is one of the key reasons behind the difference in Urban and Rural inflation (remember NBS highlighted passenger transport as part of the causes of core inflation). Generally, the cost of transporting items from rural areas to urban areas has raised the urban index above the composite index (headline inflation).

Notably, there is a substantial degree of imported inflation in Nigeria as the uplifted oil prices in the global market, together with the prices of commodities like wheat are fueling Nigeria’s inflation. It is important to note that global commodity prices are coming down; wheat has dropped in price following the grain shipment from Ukraine; OPEC basket price currently stands at $99.66 p/b, however, these prices are still above the pre-war period in Ukraine.

There are also cost push factors driving inflation in Nigeria. Security issues are a major problem as well. These highlighted factors fueling inflation are not demand-driven, and as such will require the right policy to tackle them.

Even though raising interest rates can slow overall demand to address demand-related inflationary pressures, interest rate hikes cannot resolve the remaining pandemic-related bottlenecks in global supply chains and disruptions in commodities markets due to the war in Ukraine. Raising interest rates cannot solve Nigeria’s import dependency, and neither can it remedy the increasing cost of production that is feeding inflation in Nigeria.

What Should Nigeria Do to Dial Down Inflation

A high level of importation opens up Nigeria to global economic shocks. For every supply chain disruption and geopolitical tension in the west, Nigerians are hit severely as they are on the receiving end. The country needs to stimulate the domestic production of these commodities that transmit inflation.

The manufacturing sector in Nigeria has to be strengthened. The high-level importation of finished goods not only exposes the country to external shocks but also contributes to the depletion of the foreign reserve. Regulatory authorities in the sector have a lot of work to do in stimulating local manufacturing to effectively substitute a wide range of imported products for locally produced ones.

Also, the security in the country has to be strengthened as the shrinking agricultural footprint resulting from insecurity of farmers is a major problem.