The world is unlikely to meet the goal of ending extreme poverty by 2030 as COVID-19 and the war in Ukraine have brought global poverty reduction efforts to a halt.

This is according to the Poverty and Shared Prosperity 2022 report released on Wednesday by the World Bank.

According to the report, an estimated 70 million people were pushed into extreme poverty in 2020, with about 719 million surviving on less than $2.15 a day by the end of 2022.

2020 marked a turning point in the progress being made in reducing poverty. The poorest people experienced average income losses of 4% with the losses doubling for the wealthiest people of the income distribution.

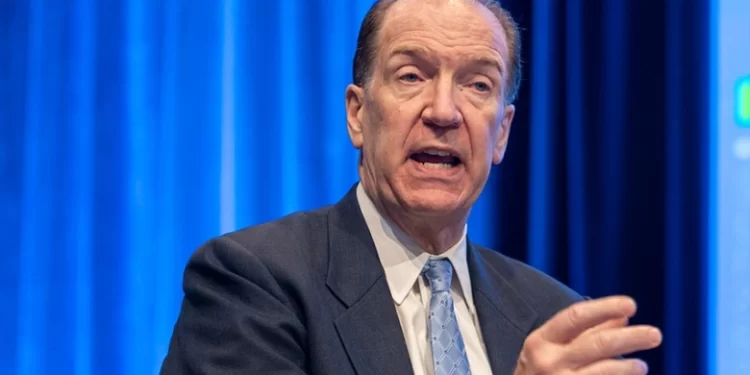

World Bank Group President David Malpass said, “progress in reducing extreme poverty has essentially halted in tandem with subdued global economic growth. Of concern to our mission is the rise in extreme poverty and the decline of shared prosperity brought by inflation, currency depreciations, and broader overlapping crises facing development. It means a grim outlook for billions of people globally. Adjustments to macroeconomic policies are needed to improve the allocation of global capital, foster currency stability, reduce inflation, and restart growth in median income. The alternative is the status quo—slowing global growth, higher interest rates, greater risk aversion, and fragility in many developing countries.”

The World Bank stated that strong fiscal policy measures played a significant role in reducing the pass-through effects of COVID-19 on poverty. Notably, government spending through fiscal policy and other support measures in advanced economies was able to fully offset the COVID-19 impacts of poverty. For upper-middle-income economies, 50% of the poverty impact was eroded. The report found that due to the less spending abilities of developing economies, little was achieved as less fiscal spending helped offset about 2.4% of poverty impact; Sub-Saharan Africa currently accounts for 60% of all people in extreme poverty—389 million, according to the report.

Following the above, each country in sub-Saharan Africa would need to realize a per-capita GDP growth of 9% per year for the remaining of this decade, to achieve the 2030 poverty goal. This is very unlikely for countries with average per-capita GDP growth of 1.2 percent in the decade before COVID-19.

What the World Bank is Saying

The international lender thinks national policy amelioration will be instrumental in setting countries back on the path of poverty reduction. Furthermore, it made these three fiscal policy recommendations.

-

Avoid broad subsidies and increase targeted cash transfers: Half of all spending on energy subsidies in low- and middle-income economies goes to the richest 20 percent of the population who consume more energy. Cash transfers are a far more effective mechanism for supporting poor and vulnerable groups.

Focus on long-term growth: High-return investments in education, research and development, and infrastructure projects need to be made today. In a time of scarce resources, more efficient spending and improved preparation for the next crisis will be key.

Mobilize domestic revenues without hurting the poor. Property taxes and carbon taxes can help raise revenue without hurting the poorest. So can broadening the base of personal and corporate income taxes. If sales and excise taxes do need to be raised, governments should minimize economic distortions and negative distributional impacts by simultaneously using targeted cash transfers to offset their effects on the most vulnerable households.