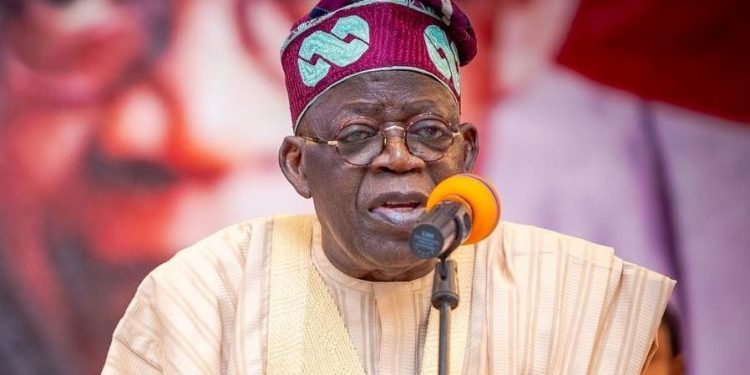

Nigeria’s foreign reserves have been experiencing a rapid decline, reaching one of its lowest levels, shedding an additional $600 million in the initial days of President Bola Tinubu’s government. This concerning trend coincides with the recent decision by the Central Bank of Nigeria to float the Nigerian currency, resulting in the Naira plummeting to a record low. The country’s foreign reserves comprise foreign banknotes, deposits, bonds, treasury bills, and other foreign government securities.

Despite the implementation of several investor-friendly policies by the new government, Nigeria’s foreign reserves continue to diminish. Data obtained from the Central Bank of Nigeria’s official website, analyzed by RateCaptain Analyst, reveals that the country’s foreign exchange reserves have declined by over $658.3 million within the first 18 days of June under President Bola Tinubu’s administration.

As of June 19, 2023, the nation’s foreign exchange reserves stood at $34.4 billion, compared to $34.5 billion on June 18, 2023, according to the data. This downward trajectory in foreign reserves follows the declining trend observed since May 2023, during the tenure of Tinubu’s predecessor, Muhammadu Buhari. In May, the reserves experienced a decrease of N684.9 million, starting the month at $35.27 billion and concluding at $35.09 billion.

Year to date, Nigeria’s foreign reserves have witnessed a decline of 6.5 percent, equivalent to $2.4 billion, from $37.08 billion on December 31st, 2022. Despite these alarming figures, there is renewed hope for Nigeria’s foreign reserves with the recent decision by the Central Bank of Nigeria to float the Naira. This move is expected to alleviate stress on the country’s foreign reserves, although it is still early to draw conclusive results. However, an early evaluation is necessary to assess the impact of this policy shift.

The decline in Nigeria’s foreign reserves raises concerns about the country’s economic stability and its ability to withstand external shocks. Foreign reserves play a crucial role in supporting the local currency, managing external debt, and ensuring financial stability. The decreasing reserves indicate potential challenges in maintaining a favorable balance of payments and meeting international obligations.

As the government works towards implementing investor-friendly policies and exploring strategies to bolster foreign reserves, it becomes imperative to address the factors contributing to this decline. Enhancing revenue generation, diversifying the economy, attracting foreign direct investment, and promoting export competitiveness are essential steps to strengthen Nigeria’s foreign reserves.

Bottom Line

Nigeria’s foreign reserves have been experiencing a worrying downward trend, with President Bola Tinubu’s administration witnessing a significant decline in a short period. The decision to float the Naira brings hope for potential relief, but further evaluation is required to determine its efficacy. Sustained efforts to attract investment, diversify the economy, and enhance revenue generation will be vital in stabilizing Nigeria’s foreign reserves and fostering long-term economic growth.