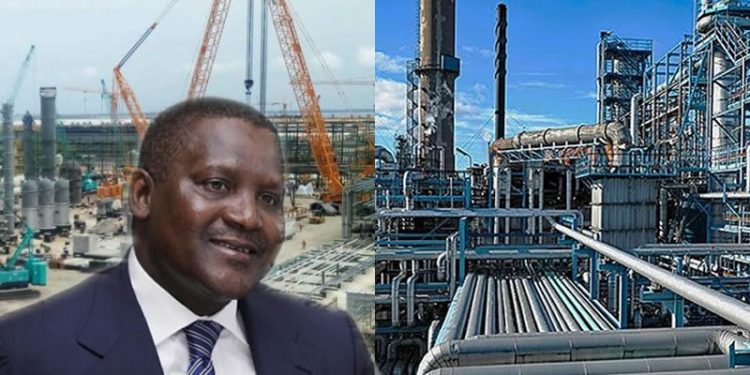

The recent commissioning of the Dangote Oil Refinery in Nigeria has generated considerable excitement and hope for an end to fuel shortages and price hikes in the country. However, industry analysts are raising concerns about the refinery’s potential impact on fuel prices. While President Aliko Dangote envisions job creation and significant revenue generation, skeptics point to the risk of price manipulation and a potential exacerbation of existing challenges. As Nigerians eagerly await the refinery’s impact on the fuel market, only time will reveal whether it will alleviate or worsen fuel price hikes.

The Optimism and Skepticism:

President Muhammadu Buhari’s commissioning of the Dangote Oil Refinery marked a momentous occasion, with hopes that it would address Nigeria’s fuel shortage and reduce price fluctuations. The Independent Petroleum Marketers Association of Nigeria (IPMAN) expressed optimism about the refinery’s potential to alleviate these challenges. However, industry analysts, including CEO Ebuka Abaebu of Steez Management Consulting, remain skeptical. Abaebu suggests that while the refinery may reduce the need for fuel imports, it may not lead to a substantial decrease or stabilization of crude oil prices.

The Concerns of Monopolistic Influence:

One of the main concerns raised by analysts is the potential monopolistic influence of the Dangote Refinery. Drawing parallels to the Dangote Cement Refinery, which resulted in a significant increase in cement prices, skeptics worry that the oil refinery could follow a similar path. The establishment of a production monopoly for Dangote may allow the company to manipulate prices at its discretion, raising concerns about potential exploitation.

Lessons from the Cement Industry:

The surge in cement prices following the establishment of the Dangote Cement Refinery serves as a cautionary tale. Cement prices skyrocketed well above their pre-refinery levels, leading to concerns about affordability. This precedent raises doubts about the optimistic projections for the oil refinery’s impact on fuel prices. It also highlights the need for vigilance in monitoring potential market exploitation.

The Uncertain Future:

As the Dangote Oil Refinery begins its operations, Nigerians eagerly await its impact on fuel availability and prices. Skeptics like Abaebu question the likelihood of substantial changes. The focus now shifts to how the refinery’s operations will shape the country’s fuel market dynamics. With its operational status confirmed, the coming months will reveal whether it successfully addresses fuel shortages and price hikes or exacerbates existing challenges.

Monitoring the Impact:

Stakeholders, including industry bodies, regulators, and citizens, will closely monitor the developments surrounding the Dangote Refinery. The refinery’s impact on the Nigerian economy and the livelihoods of its citizens remains a subject of keen interest and debate. It is crucial to assess the refinery’s effects objectively and take appropriate measures to ensure fair market practices and protect consumer interests.

Bottom line

The commissioning of the Dangote Oil Refinery in Nigeria has raised hopes for a solution to fuel shortages and price hikes. However, skepticism persists regarding its potential to bring about significant changes in fuel prices. The concern revolves around the potential monopolistic influence and the lessons learned from the cement industry. As the refinery’s operations unfold, it is essential to monitor its impact on the Nigerian fuel market diligently. Only time will reveal whether the refinery can alleviate the existing challenges or further exacerbate them, shaping the future of the country’s fuel industry.