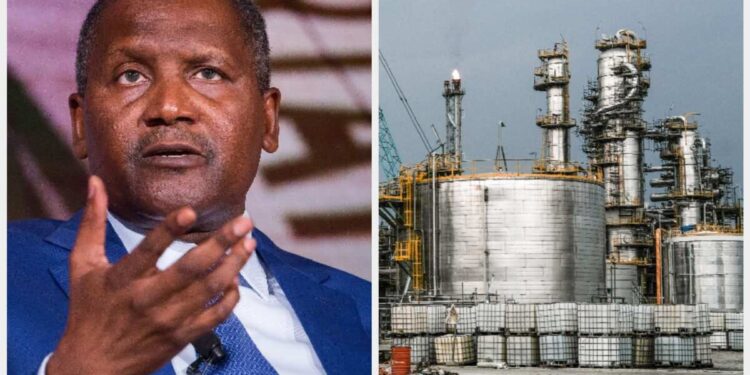

The Independent Petroleum Marketers Association of Nigeria (IPMAN) has expressed keen interest in collaborating with Dangote Petroleum Refinery as the facility gears up for the reception of its final batch of crude oil. Despite awaiting official feedback from the refinery, IPMAN has escalated its interest by sending follow-up emails.

In a letter addressed to Dangote Refinery, Abubakar Maigandi, a representative of IPMAN, revealed the association’s intention to secure product allocations from the 650,000 bpd-capacity refinery. The reported allocation of one million barrels of crude oil to the refinery on January 8, 2024, is seen as a crucial step towards initiating full-scale operations at the Lagos-based facility.

Maigandi shared that IPMAN, representing 80% of retail outlets nationwide, aims to obtain a direct allocation from Africa’s largest refinery for distribution to consumers across the country. While awaiting the refinery’s response, IPMAN remains optimistic and has initiated a follow-up correspondence.

“We want him to give us part of his allocation from his production since we cover more than 80% of Nigeria. We want to partner with him so that he can give us allocation to our marketers,” said Maigandi.

Despite a generally stable petrol market, the association highlighted ongoing transportation challenges faced by marketers. These issues stem from outstanding debts owed by the defunct Petroleum Equalisation Fund for bridging products during subsidy periods. Maigandi urged the government to settle these debts promptly for seamless product distribution.

As the Dangote Refinery nears operational status, IPMAN’s pursuit of collaboration aligns with the broader industry’s efforts to secure reliable and cost-effective fuel supplies. The Petroleum Products Retail Outlet Owners Association of Nigeria (PETROAN) has also engaged in discussions with offshore refineries to ensure a steady supply of petrol, diesel, Jet A1, and cooking gas to the Nigerian market by the first quarter of 2024.